-

×

Dol Goch Waterfall Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Dol Goch Waterfall Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

The Science of Energy: Resources and Power Explained with Michael Wysession

1 × 5,00 $

The Science of Energy: Resources and Power Explained with Michael Wysession

1 × 5,00 $ -

×

The Rational Male - Preventive Medicine by Rollo Tomassi

1 × 5,00 $

The Rational Male - Preventive Medicine by Rollo Tomassi

1 × 5,00 $ -

×

True Authentic Reality Experience - Beast Mode

1 × 5,00 $

True Authentic Reality Experience - Beast Mode

1 × 5,00 $ -

×

Learning to Light Day Exteriors with Shane Hurlbut

1 × 8,00 $

Learning to Light Day Exteriors with Shane Hurlbut

1 × 8,00 $ -

×

Policy Affects Practice & Students/Practitioners Affect Policy with Influencing Social Policy

1 × 8,00 $

Policy Affects Practice & Students/Practitioners Affect Policy with Influencing Social Policy

1 × 8,00 $ -

×

Power of 2 Marriage Skills Workshop with Susan Heitler & Abigail Hirsch

1 × 8,00 $

Power of 2 Marriage Skills Workshop with Susan Heitler & Abigail Hirsch

1 × 8,00 $ -

×

Mysterious Techniques That Will Spike Her Attraction by Arash Dibazar

1 × 5,00 $

Mysterious Techniques That Will Spike Her Attraction by Arash Dibazar

1 × 5,00 $ -

×

How To Get Your Clients To Send You More Clients with Maria Wendt

1 × 5,00 $

How To Get Your Clients To Send You More Clients with Maria Wendt

1 × 5,00 $ -

×

Evidence-Based Therapy Practices in Psilocybin-Assisted Interventions with Matthew Johnson - PESI

1 × 15,00 $

Evidence-Based Therapy Practices in Psilocybin-Assisted Interventions with Matthew Johnson - PESI

1 × 15,00 $ -

×

Referral Program with Kelli Marie Connor

1 × 5,00 $

Referral Program with Kelli Marie Connor

1 × 5,00 $ -

×

English Landscape Malham Cove Gordal Scar & Janets Foss Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

English Landscape Malham Cove Gordal Scar & Janets Foss Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Automated Income Assets with Benjamin Fletcher

1 × 5,00 $

Automated Income Assets with Benjamin Fletcher

1 × 5,00 $ -

×

Gut Health Course with Edward Group

1 × 69,00 $

Gut Health Course with Edward Group

1 × 69,00 $ -

×

Canva Mastery Bible – Your Blueprint to Amazing Canva designs - The Canva Wizard

1 × 5,00 $

Canva Mastery Bible – Your Blueprint to Amazing Canva designs - The Canva Wizard

1 × 5,00 $ -

×

Edges For Ledges 2 with Trader Dante

1 × 5,00 $

Edges For Ledges 2 with Trader Dante

1 × 5,00 $ -

×

Exploring Color and Composition with Mary Jane Begin

1 × 5,00 $

Exploring Color and Composition with Mary Jane Begin

1 × 5,00 $ -

×

The Teasing Method - Tease Her Until She Explodes: The Ultimate Guide to Going Down on a Woman by John S

1 × 5,00 $

The Teasing Method - Tease Her Until She Explodes: The Ultimate Guide to Going Down on a Woman by John S

1 × 5,00 $ -

×

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $ -

×

PSTEC with Tim Phizackerly

1 × 5,00 $

PSTEC with Tim Phizackerly

1 × 5,00 $ -

×

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $

Asset-Based Lending & Alternative Finance with Kyle Peterdy – CFI Education

15,00 $

SKU: KEB. 45706Qj6XEV4d

Category: Finance

Tags: Alternative Finance, Asset-Based Lending, CFI Education, Kyle Peterdy

Download Asset-Based Lending & Alternative Finance with Kyle Peterdy – CFI Education, check content proof here:

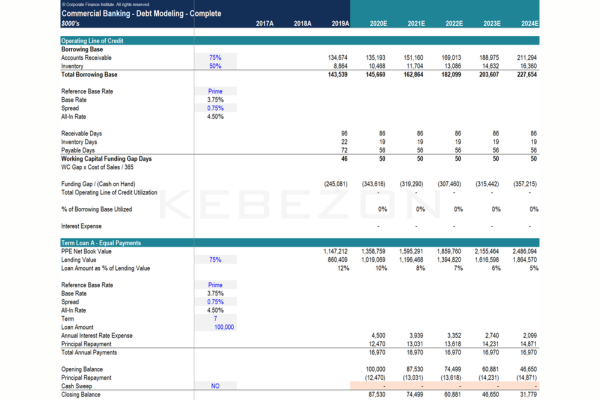

Deep Dive into Alternative Finance and Asset-Based Lending: Perspectives from Kyle Peterdy

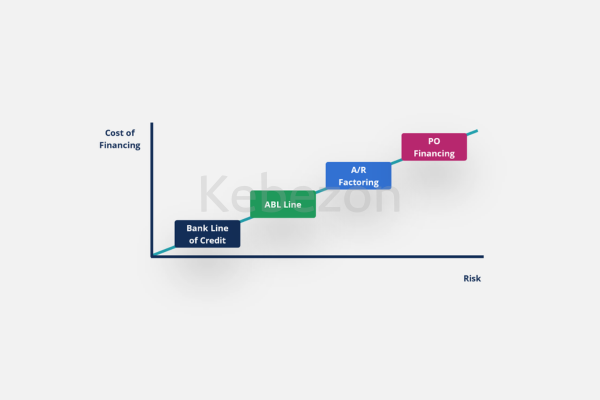

The financial landscape has undergone a noticeable transformation in recent years, which has been influenced by the evolving requirements of businesses and the changing economic conditions. Companies are investigating alternative methods to obtain the essential capital for expansion as conventional lending practices become increasingly restrictive. Kyle Peterdy’s intricate exploration of asset-based financing is a particular standout in this evolving narrative. This financial model predominantly assesses the value of a company’s assets, rather than its cash flow. This enables organizations with substantial physical or financial assets to secure loans, despite having reduced profit margins.

This transformation is indicative of a more general trend toward alternative finance, a term that incorporates a variety of non-traditional lending practices. In this article, we will explore the intricacies of asset-based lending and alternative finance, emphasizing the critical components of Peterdy’s research and the implications for businesses that are navigating the current financial landscape.

Understanding Asset-Based Lending

Asset-based lending (ABL) presents a unique approach to financing, where a company’s assets such as inventory, receivables, and equipment serve as collateral for loans. This method contrasts starkly with traditional cash flow lending, which is often contingent upon consistent revenue generation.

The Definition and Mechanics of ABL

At its core, asset-based lending allows companies with significant assets but possibly inconsistent earnings to tap into higher borrowing capacities. This is akin to a ship finding its way through rough seas by relying on its anchor; even when profits fluctuate, the underlying assets provide stability and reassurance to lenders. Companies in sectors such as manufacturing or retail often hold vast amounts of assets, which can be leveraged to secure financing.

Comparisons with Traditional Lending

To clearly understand the differences, we can break down the characteristics of asset-based lending versus traditional cash flow loans in the following table:

| Characteristic | Asset-Based Lending | Traditional Cash Flow Lending |

| Collateral | Assets such as inventory and receivables | Business cash flows and profit margins |

| Suitability | Companies with significant assets | Established firms with steady cash flow |

| Risk Assessment | Asset appraisal and liquidity analysis | Revenue and profit trajectory analysis |

| Approval Speed | Often quicker due to asset-backed nature | Can take longer due to extensive checks |

The Practical Advantages of ABL

ABL can be a substantial advantage for companies, as it not only improves access to capital but also improves the firm’s capacity to manage fluctuating cash flows. In addition, it functions as a strategic instrument for financial flexibility, enabling businesses to invest in growth opportunities and navigate through economic downturns, even when market conditions are less than favorable.

The Rise of Alternative Finance

The emergence of alternative financing options has been a response to the stricter lending standards imposed by conventional banks, as Kyle Peterdy elucidates in his discussions. A paradigm shift in the way businesses seek funding is embodied by the broad array of solutions that these methods entail.

Characteristics of Alternative Finance

Alternative finance includes a variety of mechanisms, such as peer-to-peer lending, crowdfunding, private equity, and non-bank loans. This diversification allows borrowers to tailor funding solutions that align closely with their operational needs and risk profiles.

List of Alternative Financing Methods:

- Peer-to-Peer Lending: Direct lending between individuals via online platforms.

- Crowdfunding: Raising capital from a large number of people, typically through the internet.

- Private Equity: Investment from non-public sources to finance growth in private companies.

- Merchant Cash Advances: Businesses receive a lump sum of cash in exchange for a percentage of future sales.

Shifts in Borrowing Preferences

This embrace of alternative lending signifies a cultural shift among business leaders. Once reliant on traditional institutions, many companies are now exploring diverse funding sources that offer greater agility. As highlighted by Peterdy, this trend is particularly evident among middle-market borrowers who benefit from the flexible terms that alternative finance provides.

Investment Diversification and Risk Management

Asset-based lending provides a distinctive risk management strategy in addition to an improved capital channel. Lenders can effectively mitigate risks by employing defined collections of assets as collateral, which makes this form of financing appealing to both parties involved in the lending process.

Advantages for Lenders

Asset-based loans are less hazardous for lenders because the collateral can be liquidated in the event of default. This serves as a safety net, comparable to an insurance policy, that promotes business expansion while offering assurance. Peterdy underscores that financiers can diversify their investment strategies by engaging with enterprises across a variety of sectors through ABL.

Examples of ABL in Practice

Successful case studies illustrate how companies have thrived using asset-based lending. For instance, a manufacturing firm that faced seasonal cash flow challenges successfully leveraged its inventory to secure a line of credit that allowed for operational continuity during off-peak seasons. This scenario exemplifies how ABL empowers businesses to not just survive but thrive amidst economic uncertainty.

The Road Ahead: Embracing Change

Kyle Peterdy’s insights serve as a clarion call for businesses to embrace asset-based and alternative financing methods as essential tools in today’s competitive landscape. As economic conditions evolve and regulatory environments become more stringent, corporate leaders must remain agile and informed about the available financing options.

The Future of Alternative Finance and ABL

It is probable that asset-based lending will establish a permanent position within the financial system as industries continue to evolve. Additionally, the financial sector’s ongoing digital transformation is expected to simplify the process of accessing these financing methods, enabling businesses to make more informed decisions more quickly.

Future Trends Influencing Factors:

- Technological Progressions: The implementation of data analytics innovations enables more accurate asset valuation and risk assessment.

- Market Changes: A transition to more adaptable terms and conditions that address the distinctive obstacles encountered by small and medium-sized enterprises.

- Regulatory Changes: The development of alternative finance will be significantly influenced by evolving policies.

Conclusion

In summary, Kyle Peterdy’s exploration of asset-based lending and alternative finance offers valuable insights into an increasingly vital sector of the financial landscape. With economic uncertainties looming and traditional lending practices tightening, understanding these concepts is crucial for businesses seeking to enhance their financial flexibility. As we have delved into the mechanics and implications of asset-based lending, it is clear that both businesses and lenders stand to gain from this approach. Embracing these methods will not only secure necessary funding during challenging times but also pave the way for sustainable growth in a rapidly changing environment.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Asset-Based Lending & Alternative Finance with Kyle Peterdy – CFI Education” Cancel reply

You must be logged in to post a review.

Related products

Finance

Reviews

There are no reviews yet.