-

×

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $ -

×

The 3 Day “Attention Hacking” VIP Workshop with Stefan Georgi

1 × 5,00 $

The 3 Day “Attention Hacking” VIP Workshop with Stefan Georgi

1 × 5,00 $ -

×

What Women Want with Tripp Advice

1 × 5,00 $

What Women Want with Tripp Advice

1 × 5,00 $ -

×

The Silverback Seduction System by Shane Stanfield

1 × 5,00 $

The Silverback Seduction System by Shane Stanfield

1 × 5,00 $ -

×

How Science Shapes Science Fiction with Charles Adler

1 × 5,00 $

How Science Shapes Science Fiction with Charles Adler

1 × 5,00 $ -

×

Compounding Growth Mastery Elite with Simpler Trading

1 × 5,00 $

Compounding Growth Mastery Elite with Simpler Trading

1 × 5,00 $ -

×

Data Collection on the Web with Chris Mercer

1 × 39,00 $

Data Collection on the Web with Chris Mercer

1 × 39,00 $ -

×

Extreme Social Proof Aphrodisiac 5.11G (Type A/B/C/D Hybrid) with Subliminal Shop

1 × 93,00 $

Extreme Social Proof Aphrodisiac 5.11G (Type A/B/C/D Hybrid) with Subliminal Shop

1 × 93,00 $

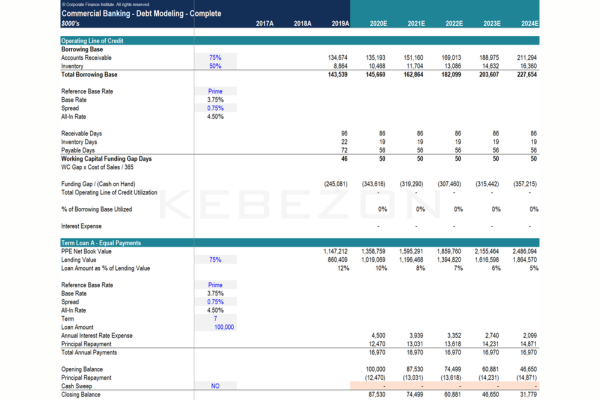

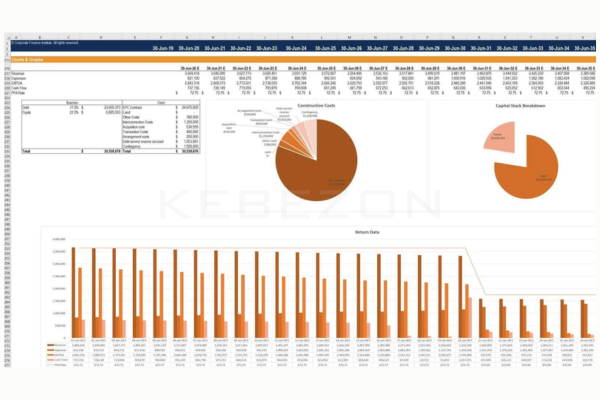

Commercial Banking – Debt Modeling with Tim Vipond – CFI Education

15,00 $

SKU: KEB. 537547Bk9m5

Category: Finance

Tags: CFI Education, Commercial Banking, Debt Modeling, Tim Vipond

You may check content proof of “Commercial Banking – Debt Modeling with Tim Vipond – CFI Education” below:

Commercial banking – Debt modeling: Review of Tim Vipond’s Course

In the dynamic realm of finance, the art and science of debt modeling emerge as vital tools for evaluating a borrower’s viability. The Commercial Banking – Debt Modeling course led by Tim Vipond at the Corporate Finance Institute (CFI) offers a structured pathway into this intricate world. It equips finance professionals with essential skills, fostering a deeper understanding of cash flows and covenant analysis, ultimately empowering them to enhance their risk management capabilities. This course is not merely a collection of lectures; it’s a comprehensive toolkit for those navigating the often turbulent waters of commercial banking.

The Importance of Debt Modeling

Debt modeling, fundamentally, is akin to constructing a sturdy bridge; it must be built on a solid foundation to withstand the pressures of financial uncertainty. In commercial banking, understanding a borrower’s ability to meet obligations is critical. Tim Vipond’s course delves into the nuances of debt modeling, helping participants discern between different types of financing arrangements. For instance, the distinction between operating finance, like lines of credit, and term lending, which encompasses various loans, is emphasized throughout the curriculum.

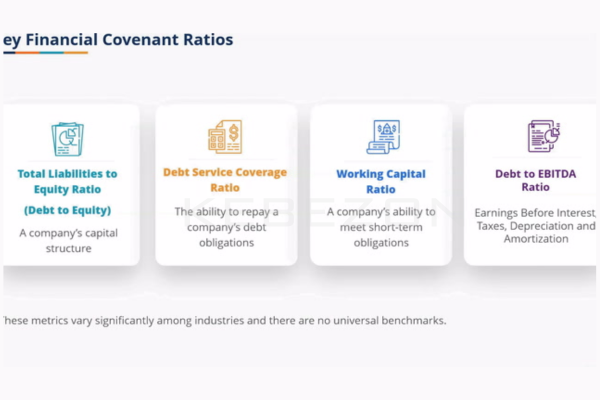

The curriculum is structured to illuminate not just the theoretical aspects of debt but also the practical skills needed to navigate real-world situations. Throughout the course, participants engage with detailed yearly debt schedules and gain insights into covenant analysis. The anticipation of potential breaches of agreements acts as a safety net, allowing financial analysts to proactively engage with their clients. This insightful approach transforms complex financial concepts into manageable, actionable strategies, fostering a holistic understanding of commercial banking.

Practical Skills Developed in the Course

The hands-on nature of Vipond’s teaching enables participants to develop practical skills that are invaluable in financial fields. By the end of this focused journey, aspiring credit analysts and finance professionals will find themselves adept in several key areas:

- Building Comprehensive Debt Models: Participants learn to create models that seamlessly incorporate cash flow forecasts. These models help gauge a company’s capacity to handle its debt obligations while providing a roadmap for future financial planning.

- Performing Covenant Analysis: Understanding and analyzing covenants dates back centuries but remains increasingly relevant today. This course guides participants through the intricacies of covenant structures, preparing them to recognize early warning signs of potential violations.

- Evaluating Debt Capacity: Knowing how to evaluate a borrower’s debt capacity ensures that participants can provide sound recommendations to stakeholders. This task requires a combination of quantitative skills and qualitative insights, and the course nurtures both.

These practical skills create a foundation not just for individual success but also for organizational resilience. By enhancing risk management capabilities, participants arm themselves with tools essential for burdening the weight of decision-making in the ever-evolving landscape of commercial banking.

Course Structure and Accessibility

One of the silver linings of the Commercial Banking – Debt Modeling course is its self-paced structure. Estimated to take around 4.5 hours, this format allows financial professionals to integrate the training into their busy schedules seamlessly. It recognizes the realities of modern learners who juggle multiple responsibilities while striving to enhance their knowledge.

The course delivers content via an online platform, which resonates particularly well in the post-pandemic era. The digital format not only accommodates various learning styles but also allows participants to revisit complex topics as needed. This blend of flexibility and rigor makes it an attractive option for those committed to advancing their careers.

Recommended Audience and Benefits

This course is tailored for individuals with a foundational understanding of finance, targeting those eager to deepen their expertise in debt modeling techniques. It serves a diverse audience, ranging from recent graduates to seasoned professionals in commercial banking and credit analysis. The blend of advanced level content and practical applications creates a unique learning environment conducive to professional development.

Participants can expect numerous benefits from engaging in this comprehensive training:

- Enhanced Analytical Skills: The course hones analytical skills that are critical for effective credit analysis and loan evaluation.

- Improved Decision-Making Abilities: By developing robust debt models, participants can provide well-informed recommendations, bolstering confidence in financial decision-making.

- Networking Opportunities: Engaging with peers in the course offers additional networking prospects, which can be invaluable in a field where relationships and trust are paramount.

Concluding Thoughts

The Commercial Banking – Debt Modeling course by Tim Vipond stands out as a remarkable resource within the landscape of financial training. Through a perfect blend of theoretical knowledge and practical skills, it caters to the growing need for advanced understanding in commercial banking. The focus on cash flows, covenant analysis, and debt capacity evaluation harmonizes well with the demands of today’s finance professionals.

In a world where risk is inherent and the financial landscape is constantly shifting, being well-equipped with the right knowledge and skills is not just beneficial it’s essential. By investing time in this course, participants take significant steps toward mastering the art of debt modeling, ultimately enabling them to better serve their clients and advance their careers in this competitive industry.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Commercial Banking – Debt Modeling with Tim Vipond – CFI Education” Cancel reply

You must be logged in to post a review.

Related products

Finance

Reviews

There are no reviews yet.