-

×

How Music and Mathematics Relate with David Kung

1 × 5,00 $

How Music and Mathematics Relate with David Kung

1 × 5,00 $ -

×

Free Traffic Workshop with Tony Shepherd

1 × 5,00 $

Free Traffic Workshop with Tony Shepherd

1 × 5,00 $ -

×

The Content Domination System with Rachel Pedersen

1 × 31,00 $

The Content Domination System with Rachel Pedersen

1 × 31,00 $ -

×

SHIFT by Julien Blanc

1 × 5,00 $

SHIFT by Julien Blanc

1 × 5,00 $ -

×

Power of 2 Marriage Skills Workshop with Susan Heitler & Abigail Hirsch

1 × 8,00 $

Power of 2 Marriage Skills Workshop with Susan Heitler & Abigail Hirsch

1 × 8,00 $ -

×

The Iodine Crisis: What You Don’t Know About Iodine Can Wreck Your Life (PDF+Mp3) with Lynne Farrow

1 × 6,00 $

The Iodine Crisis: What You Don’t Know About Iodine Can Wreck Your Life (PDF+Mp3) with Lynne Farrow

1 × 6,00 $ -

×

Backpacking 101 with Sienna Fry

1 × 6,00 $

Backpacking 101 with Sienna Fry

1 × 6,00 $ -

×

Your Easy Phone Money Membership

1 × 5,00 $

Your Easy Phone Money Membership

1 × 5,00 $ -

×

Oechsli Learning Center

1 × 69,00 $

Oechsli Learning Center

1 × 69,00 $ -

×

The system - High impact health strategies by George Ferman

1 × 31,00 $

The system - High impact health strategies by George Ferman

1 × 31,00 $ -

×

How To Get Your Clients To Send You More Clients with Maria Wendt

1 × 5,00 $

How To Get Your Clients To Send You More Clients with Maria Wendt

1 × 5,00 $ -

×

Penis Enlargement & Virtual Viagra with Wendi Friesen

1 × 5,00 $

Penis Enlargement & Virtual Viagra with Wendi Friesen

1 × 5,00 $ -

×

90-Minute Novel with Nathan Baugh & Nicolas Cole - Ship 30 for 30

1 × 5,00 $

90-Minute Novel with Nathan Baugh & Nicolas Cole - Ship 30 for 30

1 × 5,00 $ -

×

Profiting from PopSockets: Monetize the Hottest Aesthetics for PopSocket Designs with DALL-E 3 - ChatGPT Prompt Engineering

1 × 5,00 $

Profiting from PopSockets: Monetize the Hottest Aesthetics for PopSocket Designs with DALL-E 3 - ChatGPT Prompt Engineering

1 × 5,00 $ -

×

Erection Enhancement with Charles Runels

1 × 5,00 $

Erection Enhancement with Charles Runels

1 × 5,00 $ -

×

Bach and the High Baroque with Robert Greenberg

1 × 5,00 $

Bach and the High Baroque with Robert Greenberg

1 × 5,00 $ -

×

Both Regression and Parts Workshops with Roy Hunter

1 × 101,00 $

Both Regression and Parts Workshops with Roy Hunter

1 × 101,00 $ -

×

AX 1 with Jeff Cavaliere - AthleanX

1 × 5,00 $

AX 1 with Jeff Cavaliere - AthleanX

1 × 5,00 $ -

×

Blackhat Facebook Traffic with Harlan Kilstein

1 × 5,00 $

Blackhat Facebook Traffic with Harlan Kilstein

1 × 5,00 $ -

×

Shamanic Plant Spirit Initiations with Emma Fitchett - The Shift Network

1 × 54,00 $

Shamanic Plant Spirit Initiations with Emma Fitchett - The Shift Network

1 × 54,00 $ -

×

Introduction To Redshift Render Engine with Dustin Valkema

1 × 8,00 $

Introduction To Redshift Render Engine with Dustin Valkema

1 × 8,00 $ -

×

Classic jiu-jitsu with Mauricio Gomes

1 × 6,00 $

Classic jiu-jitsu with Mauricio Gomes

1 × 6,00 $ -

×

Road to Rediscovery by Donna Hill

1 × 5,00 $

Road to Rediscovery by Donna Hill

1 × 5,00 $ -

×

Master Strategic Order Flow Trading with Mike Valtos

1 × 20,00 $

Master Strategic Order Flow Trading with Mike Valtos

1 × 20,00 $ -

×

English Landscape Malham Cove Gordal Scar & Janets Foss Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

English Landscape Malham Cove Gordal Scar & Janets Foss Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Cement Studio 3D Model with PRO EDU

1 × 8,00 $

Cement Studio 3D Model with PRO EDU

1 × 8,00 $ -

×

How To Set Up Your Own SEO Agency From Home - 100% Fully Automated Business System - Uper Agency

1 × 5,00 $

How To Set Up Your Own SEO Agency From Home - 100% Fully Automated Business System - Uper Agency

1 × 5,00 $ -

×

eBay Cash Magnet - Unlocking Wealth with Virtual Goods & Zero Inventory - Jafar Najafov

1 × 5,00 $

eBay Cash Magnet - Unlocking Wealth with Virtual Goods & Zero Inventory - Jafar Najafov

1 × 5,00 $ -

×

Girlfriend In A Week System with Jonathan Green

1 × 5,00 $

Girlfriend In A Week System with Jonathan Green

1 × 5,00 $ -

×

Awaken Extreme Drive (Advanced) with Spirituality Zone

1 × 15,00 $

Awaken Extreme Drive (Advanced) with Spirituality Zone

1 × 15,00 $ -

×

Sealfit 7 - Core Training with Sealfit

1 × 5,00 $

Sealfit 7 - Core Training with Sealfit

1 × 5,00 $ -

×

English Landscape Nidderdale Composite Stock Assets 1 with Clinton Lofthouse

1 × 8,00 $

English Landscape Nidderdale Composite Stock Assets 1 with Clinton Lofthouse

1 × 8,00 $ -

×

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $ -

×

The Teasing Method - Tease Her Until She Explodes: The Ultimate Guide to Going Down on a Woman by John S

1 × 5,00 $

The Teasing Method - Tease Her Until She Explodes: The Ultimate Guide to Going Down on a Woman by John S

1 × 5,00 $ -

×

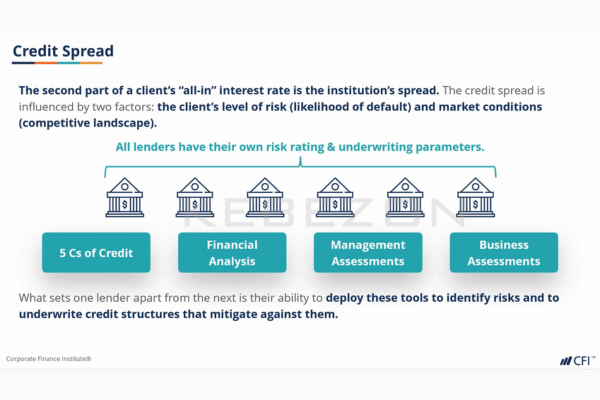

Loan Pricing with Kyle Peterdy - CFI Education

1 × 15,00 $

Loan Pricing with Kyle Peterdy - CFI Education

1 × 15,00 $ -

×

Mysteries of the Microscopic World with Bruce Fleury

1 × 5,00 $

Mysteries of the Microscopic World with Bruce Fleury

1 × 5,00 $ -

×

Effortless Content: The Quick & Dirty Way To Create GREAT Content - Ryan Booth

1 × 5,00 $

Effortless Content: The Quick & Dirty Way To Create GREAT Content - Ryan Booth

1 × 5,00 $ -

×

Social Training Lab Mentorship with Bobby Rio

1 × 5,00 $

Social Training Lab Mentorship with Bobby Rio

1 × 5,00 $ -

×

Back Attacks with Igor Gracie

1 × 6,00 $

Back Attacks with Igor Gracie

1 × 6,00 $ -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × 443,00 $

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × 443,00 $ -

×

Power BI Financial Statements with Sebastian Taylor & Joseph Yeates - CFI Education

1 × 15,00 $

Power BI Financial Statements with Sebastian Taylor & Joseph Yeates - CFI Education

1 × 15,00 $ -

×

Triple Cash E-Book with Amanda Craven

1 × 5,00 $

Triple Cash E-Book with Amanda Craven

1 × 5,00 $ -

×

6 Weeks of THE WORK - Amoila Cesar - Beachbody

1 × 5,00 $

6 Weeks of THE WORK - Amoila Cesar - Beachbody

1 × 5,00 $ -

×

The Manosphere - A New Hope for Masculinity with Ian Ironwood

1 × 5,00 $

The Manosphere - A New Hope for Masculinity with Ian Ironwood

1 × 5,00 $ -

×

AI Client Goldmine with Offline Sharks

1 × 5,00 $

AI Client Goldmine with Offline Sharks

1 × 5,00 $ -

×

Auto-Affiliate AI - Live Demo: Watch This ChatGPT App Passively

1 × 5,00 $

Auto-Affiliate AI - Live Demo: Watch This ChatGPT App Passively

1 × 5,00 $ -

×

Resolving Regret with Steve Andreas

1 × 15,00 $

Resolving Regret with Steve Andreas

1 × 15,00 $ -

×

Money Machine GPT with Lee Cole & Gloria Gunn

1 × 5,00 $

Money Machine GPT with Lee Cole & Gloria Gunn

1 × 5,00 $ -

×

Renzo Gracie - Special Class with Renzo Gracie

1 × 6,00 $

Renzo Gracie - Special Class with Renzo Gracie

1 × 6,00 $ -

×

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $ -

×

Pro YouTuber with Joshua Mayo

1 × 22,00 $

Pro YouTuber with Joshua Mayo

1 × 22,00 $ -

×

SQL for Marketers with Sridhar Kamma

1 × 39,00 $

SQL for Marketers with Sridhar Kamma

1 × 39,00 $ -

×

COMBAT SYSTEMA Bundle - Combat Professor

1 × 31,00 $

COMBAT SYSTEMA Bundle - Combat Professor

1 × 31,00 $ -

×

Dappled Light Forest Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Dappled Light Forest Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Olde English Abbey Composite Stock Assets 4 with Clinton Lofthouse

1 × 8,00 $

Olde English Abbey Composite Stock Assets 4 with Clinton Lofthouse

1 × 8,00 $ -

×

The PDF Method™

1 × 5,00 $

The PDF Method™

1 × 5,00 $ -

×

Alkaline Awakening with Revival Of Wisdom

1 × 5,00 $

Alkaline Awakening with Revival Of Wisdom

1 × 5,00 $ -

×

Viral Content Creator AI Automation 2024 with Zita

1 × 5,00 $

Viral Content Creator AI Automation 2024 with Zita

1 × 5,00 $ -

×

Positive Psychology and Psychotherapy with Martin Seligman

1 × 8,00 $

Positive Psychology and Psychotherapy with Martin Seligman

1 × 8,00 $ -

×

Weight Loss Bootcamp with Hypnosis Bootcamp

1 × 39,00 $

Weight Loss Bootcamp with Hypnosis Bootcamp

1 × 39,00 $ -

×

xShot Email Method Course

1 × 5,00 $

xShot Email Method Course

1 × 5,00 $

Financial Calm – Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

799,00 $ Original price was: 799,00 $.31,00 $Current price is: 31,00 $.

SKU: KEB. 44527EE3Y1TC2

Category: Marketing

Tags: Financial Calm, Ready2Go Marketing Solutions, Self-Study Online Course, Teleseminar

Download Financial Calm – Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions, check content proof here:

Financial calm: Teleseminar & self-study online course review by Ready2Go Marketing Solutions

In a world where many people consider financial stability to be an unattainable goal, Ready2Go Marketing Solutions’ Financial Calm: Teleseminar & Self-Study Online Course stands out as a ray of hope. This extensive program provides a systematic pathway aimed at promoting better financial attitudes and enabling participants to approach debt with confidence. It was painstakingly designed to help people navigate the complex maze of financial management. This dual-format course accommodates a variety of learning styles by striking a balance between in-person engagement and self-directed learning, guaranteeing that every participant may connect with the content in a meaningful way. This article explores the program’s specifics, looking at its design, main results, and general efficacy in guiding people toward financial independence.

Overview of the Financial Calm Program

The Financial Calm program is precisely tailored for those who find themselves ensnared in the complexities of managing their finances. With two main components the live teleseminar and the self-study online course participants are offered both structured engagement and the flexibility of independent learning. Priced equally at $579, these options allow individuals to choose their preferred mode of learning based on personal preferences and time availability.

Participants can communicate in real time with both competent professors and other students throughout the live teleseminar. In contrast to typical learning environments, this format offers a rare chance for instant feedback, shared ideas, and a sense of community. The course material is extensive and includes well crafted activities, agendas, and handouts that enhance the in-person conversations.

However, the online self-study course offers a more adaptable option. It allows participants to learn at their own speed, making it perfect for people who value independence in their education. With organized modules meant to support self-directed learning, the self-study course mirrors the content of the teleseminar while allowing participants to engage with the material in a way that suits their schedule and learning style.

Course Structure

The Financial Calm program’s content is systematically divided into two components:

- Teleseminar:

- Live, interactive format

- Comprehensive content such as agendas, exercises, and handouts

- Real-time engagement and insights

- Priced at $579

- Self-Study Online Course:

- Flexible, self-paced learning modules

- Consists of 4-7 modules covering essential financial decision-making

- Includes activities and follow-up plans for reinforcing learning

- Also priced at $579

This dual structure not only caters to different learning preferences but also ensures that participants receive a holistic understanding of financial management principles.

Key Learning Outcomes

Every well-crafted course promises valuable takeaways, and the Financial Calm program is no exception. The key learning outcomes of this course revolve around enhancing financial literacy and preparing participants for effective debt management. Some of the pivotal areas covered include:

- Acknowledging the Five Truths About Debt: Effective debt management requires an awareness of the basic facts around debt. Making wise financial decisions requires that participants be able to distinguish between good and bad debt.

- Implementing Steps for Debt Reduction: The course promotes a proactive approach to financial management by outlining concrete steps people may take to get ready for a debt-free existence.

- Examining Emotional Attachments to Spending: This course’s emphasis on the emotional side of money is one of its distinctive features. In order to create a more mindful approach to money management, participants are urged to consider their spending patterns and the psychological aspects that affect their financial choices.

Engaging Activities

The program does not merely aim to impart knowledge; it actively engages participants in the learning process. Through various activities and exercises, attendees can:

- Develop personalized financial plans tailored to their unique situations.

- Identify their current financial condition, promoting awareness and accountability.

- Set and prioritize financial goals, transforming abstract concepts into achievable targets.

By emphasizing real-world application, the Financial Calm program fosters a sense of ownership over one’s financial situation, encouraging participants to take the reins of their financial journey.

Transforming Mindsets towards Financial Wellness

A key tenet of the course is the transformation of participants’ mindsets regarding money. Rather than viewing finances purely in terms of numbers and budgets, the Financial Calm program encourages individuals to cultivate a nuanced understanding of their financial wellness. Through a combination of theoretical knowledge and practical strategies, participants are equipped to redefine their relationship with money.

Practical Steps to Improve Financial Literacy

The course offers a plethora of practical tips and strategies to enhance financial literacy, including:

- Budgeting Techniques: Learning advanced budgeting methods that go beyond simple tracking, helping participants allocate resources strategically.

- Debt Management Solutions: Identifying effective strategies to address and reduce debt, ultimately leading to financial freedom.

- Investment Awareness: Introducing basic investment concepts to empower participants in making informed decisions about their money.

This focus on practical application ensures that individuals leave the program not only with theoretical knowledge but also with actionable steps they can take to improve their financial situations.

Participant Experiences and Testimonials

Although statistics and course material offer insightful information about a program’s efficacy, firsthand accounts lend a degree of credibility. After completing the Financial Calm program, participants frequently tell life-changing tales of their financial freedom journeys.

After taking the course, several participants have experienced notable decreases in their anxiety and financial burden. A recurring element in testimonies is the change of perspective from considering financial difficulties as insurmountable barriers to considering them as controllable issues. Additionally, the course’s engaging style is often praised by participants, especially the teleseminar’s involvement, which promotes a feeling of community and shared learning.

Example Testimonials

A selection of testimonials might include:

- “Before taking this course, I was overwhelmed by my debt. Now, I feel empowered and equipped with real strategies to regain control over my finances.”

- “The emotional insights provided in the course made me realize how much my spending habits were tied to my feelings. I’m now more mindful and intentional with my money.”

These firsthand accounts not only highlight the benefits of the course but also emphasize its impact on participants’ overall financial wellness.

Conclusion

In conclusion, the Financial Calm: Teleseminar & Self-Study Online Course by Ready2Go Marketing Solutions stands as a formidable resource for individuals seeking to navigate their financial challenges with greater clarity and confidence. Through a structured approach that balances live interaction with self-directed learning, this program offers invaluable tools for achieving financial independence.

Effective methods and increased financial awareness are still crucial as the financial industry changes constantly. In addition to being intellectually stimulating, the knowledge acquired in this course motivates participants to make real life adjustments, emphasizes the significance of comprehending the emotional aspects of spending, and eventually results in better financial practices.

Achieving financial well-being is a difficult task, but with the correct support and tools, like those offered by the Financial Calm program, people may set out on this path with renewed confidence and optimism. Participants are on the way to not just controlling their debts but also reshaping their financial destiny, whether through the lively live teleseminar or the adaptable self-study online course.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Financial Calm – Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions” Cancel reply

You must be logged in to post a review.

Related products

Marketing

Marketing

Marketing

Reviews

There are no reviews yet.