-

×

English Landscape Malham Cove Gordal Scar & Janets Foss Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

English Landscape Malham Cove Gordal Scar & Janets Foss Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

JOYRYDE Style Bass House Start To Finish with Dan Larsson

1 × 15,00 $

JOYRYDE Style Bass House Start To Finish with Dan Larsson

1 × 15,00 $ -

×

The Power of Decision with Raymond Charles Barker

1 × 5,00 $

The Power of Decision with Raymond Charles Barker

1 × 5,00 $ -

×

eBay Cash Magnet - Unlocking Wealth with Virtual Goods & Zero Inventory - Jafar Najafov

1 × 5,00 $

eBay Cash Magnet - Unlocking Wealth with Virtual Goods & Zero Inventory - Jafar Najafov

1 × 5,00 $ -

×

Elite POD Course + Playbook with Jesse Anselm

1 × 26,00 $

Elite POD Course + Playbook with Jesse Anselm

1 × 26,00 $ -

×

AI Branding Beast with Mark Hess

1 × 5,00 $

AI Branding Beast with Mark Hess

1 × 5,00 $ -

×

Persona AI Training with Mark Hess

1 × 5,00 $

Persona AI Training with Mark Hess

1 × 5,00 $ -

×

The Urban Monk with Pedram Shojai

1 × 5,00 $

The Urban Monk with Pedram Shojai

1 × 5,00 $ -

×

Rainmaker Novation 3.0 - Richard Wonders

1 × 31,00 $

Rainmaker Novation 3.0 - Richard Wonders

1 × 31,00 $ -

×

Being Confident Is Accepting The Good And The Bad with Cory Skyy

1 × 5,00 $

Being Confident Is Accepting The Good And The Bad with Cory Skyy

1 × 5,00 $ -

×

English Landscape Nidderdale Composite Stock Assets 1 with Clinton Lofthouse

1 × 8,00 $

English Landscape Nidderdale Composite Stock Assets 1 with Clinton Lofthouse

1 × 8,00 $ -

×

Credit Administration and Documentation with Scott Powell - CFI Education

1 × 15,00 $

Credit Administration and Documentation with Scott Powell - CFI Education

1 × 15,00 $ -

×

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $ -

×

Auto-Affiliate AI - Live Demo: Watch This ChatGPT App Passively

1 × 5,00 $

Auto-Affiliate AI - Live Demo: Watch This ChatGPT App Passively

1 × 5,00 $ -

×

The Envisioning Method with Vishen Lakhiani

1 × 5,00 $

The Envisioning Method with Vishen Lakhiani

1 × 5,00 $ -

×

Selling on Amazon: Perfecting Traffic and Conversions - Mina Elias

1 × 39,00 $

Selling on Amazon: Perfecting Traffic and Conversions - Mina Elias

1 × 39,00 $ -

×

Crimson Lotus with Arash Dibazar

1 × 5,00 $

Crimson Lotus with Arash Dibazar

1 × 5,00 $ -

×

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $ -

×

Marketing Mastery to RaiseUp Your Business by Kami Guildner

1 × 93,00 $

Marketing Mastery to RaiseUp Your Business by Kami Guildner

1 × 93,00 $ -

×

Customer Segmentation for Ecommerce - George Kapernaros

1 × 39,00 $

Customer Segmentation for Ecommerce - George Kapernaros

1 × 39,00 $ -

×

Bodybuilding Beyond the Basics - Alberto Nunez

1 × 5,00 $

Bodybuilding Beyond the Basics - Alberto Nunez

1 × 5,00 $ -

×

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $ -

×

Steps to Everyday Productivity - April and Eric Perry

1 × 22,00 $

Steps to Everyday Productivity - April and Eric Perry

1 × 22,00 $ -

×

Pro Photo Editing Course by Maarten Schrader

1 × 46,00 $

Pro Photo Editing Course by Maarten Schrader

1 × 46,00 $ -

×

Joy of Massage With Tessa Canzona

1 × 6,00 $

Joy of Massage With Tessa Canzona

1 × 6,00 $ -

×

AgencyLab.io – Agency Accelerator with Joel Kaplan

1 × 5,00 $

AgencyLab.io – Agency Accelerator with Joel Kaplan

1 × 5,00 $ -

×

Traffic Stream with Fergal Downes

1 × 5,00 $

Traffic Stream with Fergal Downes

1 × 5,00 $ -

×

True Authentic Reality Experience - Beast Mode

1 × 5,00 $

True Authentic Reality Experience - Beast Mode

1 × 5,00 $ -

×

Interview Series with Love Systems

1 × 5,00 $

Interview Series with Love Systems

1 × 5,00 $ -

×

Business by Design: Protocol By Unlock Your Design Academy

1 × 23,00 $

Business by Design: Protocol By Unlock Your Design Academy

1 × 23,00 $ -

×

Method Self-Study by Yes Supply

1 × 23,00 $

Method Self-Study by Yes Supply

1 × 23,00 $ -

×

GearGods Presents: Mastering Metal Mixing: Finalizing Your Mix with Eyal Levi

1 × 5,00 $

GearGods Presents: Mastering Metal Mixing: Finalizing Your Mix with Eyal Levi

1 × 5,00 $ -

×

Systems Health Care Next Level - Series 4 By Stephen Gangemi - Systems Health Care

1 × 93,00 $

Systems Health Care Next Level - Series 4 By Stephen Gangemi - Systems Health Care

1 × 93,00 $ -

×

Four Steps to Encreasing Intuition with Court of Atonement

1 × 8,00 $

Four Steps to Encreasing Intuition with Court of Atonement

1 × 8,00 $ -

×

xShot Email Method Course

1 × 5,00 $

xShot Email Method Course

1 × 5,00 $ -

×

Extreme Social Proof Aphrodisiac 5.11G (Type A/B/C/D Hybrid) with Subliminal Shop

1 × 93,00 $

Extreme Social Proof Aphrodisiac 5.11G (Type A/B/C/D Hybrid) with Subliminal Shop

1 × 93,00 $ -

×

Memoir – True Story Software Add-On with John Truby

1 × 23,00 $

Memoir – True Story Software Add-On with John Truby

1 × 23,00 $ -

×

Inboxlab.io Program by Jimmy Fung

1 × 5,00 $

Inboxlab.io Program by Jimmy Fung

1 × 5,00 $ -

×

The 12-Week Rapid Transformation Intensive by Benjamin Hardy

1 × 25,00 $

The 12-Week Rapid Transformation Intensive by Benjamin Hardy

1 × 25,00 $ -

×

Amazing Selling Machine 14+Bonuses UP2 - Matt Clark

1 × 5,00 $

Amazing Selling Machine 14+Bonuses UP2 - Matt Clark

1 × 5,00 $ -

×

The Power Of Instagram By Club Life Design

1 × 5,00 $

The Power Of Instagram By Club Life Design

1 × 5,00 $ -

×

Burn the Fat, Feed the Muscle Transform Your Body Forever Using the Secrets of the Leanest People in the World - Tom Venuto

1 × 5,00 $

Burn the Fat, Feed the Muscle Transform Your Body Forever Using the Secrets of the Leanest People in the World - Tom Venuto

1 × 5,00 $ -

×

AX 1 with Jeff Cavaliere - AthleanX

1 × 5,00 $

AX 1 with Jeff Cavaliere - AthleanX

1 × 5,00 $ -

×

10 Part Business Start with Michael Sasser

1 × 23,00 $

10 Part Business Start with Michael Sasser

1 × 23,00 $ -

×

Reclaiming Ancient Dreamways with Robert Moss - The Shift Network

1 × 93,00 $

Reclaiming Ancient Dreamways with Robert Moss - The Shift Network

1 × 93,00 $ -

×

The CEO Club with Jamie Sea

1 × 29,00 $

The CEO Club with Jamie Sea

1 × 29,00 $ -

×

Dol Goch Waterfall Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Dol Goch Waterfall Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

ATTRACTION MASTERY Course with Mystery and Beckster

1 × 194,00 $

ATTRACTION MASTERY Course with Mystery and Beckster

1 × 194,00 $ -

×

The Magnetic Collective with Becky Keen

1 × 69,00 $

The Magnetic Collective with Becky Keen

1 × 69,00 $ -

×

The Inner Dimensions of Mastering Money by Tami Simon

1 × 31,00 $

The Inner Dimensions of Mastering Money by Tami Simon

1 × 31,00 $ -

×

Free Traffic Workshop with Tony Shepherd

1 × 5,00 $

Free Traffic Workshop with Tony Shepherd

1 × 5,00 $ -

×

Recycle Your Art with Andrea Chebeleu

1 × 5,00 $

Recycle Your Art with Andrea Chebeleu

1 × 5,00 $ -

×

Oechsli Learning Center

1 × 69,00 $

Oechsli Learning Center

1 × 69,00 $ -

×

The Replaceable Founder Course with Ari Meisel

1 × 209,00 $

The Replaceable Founder Course with Ari Meisel

1 × 209,00 $ -

×

The Unchained Man: The Alpha Male 2.0 with Caleb Jones

1 × 5,00 $

The Unchained Man: The Alpha Male 2.0 with Caleb Jones

1 × 5,00 $ -

×

MageAI Unlimited with Satish Gaire

1 × 5,00 $

MageAI Unlimited with Satish Gaire

1 × 5,00 $ -

×

Textures Rural Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Textures Rural Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Film Booth – The Avatar Workshop 2023

1 × 5,00 $

Film Booth – The Avatar Workshop 2023

1 × 5,00 $ -

×

The Persuasion Equation - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $

The Persuasion Equation - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $ -

×

Channel Junkies University Premium with Channel Junkies

1 × 209,00 $

Channel Junkies University Premium with Channel Junkies

1 × 209,00 $ -

×

Alkaline Awakening with Revival Of Wisdom

1 × 5,00 $

Alkaline Awakening with Revival Of Wisdom

1 × 5,00 $ -

×

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $ -

×

RANK AND RENT with Tony Newton

1 × 5,00 $

RANK AND RENT with Tony Newton

1 × 5,00 $ -

×

Rope Flow Beginners – 8-WEEKS TO FLUIDITY with Timothy Shieff

1 × 5,00 $

Rope Flow Beginners – 8-WEEKS TO FLUIDITY with Timothy Shieff

1 × 5,00 $ -

×

Strong Core Tight Abs Workout Challenge - DanceFit By Monica Landois

1 × 6,00 $

Strong Core Tight Abs Workout Challenge - DanceFit By Monica Landois

1 × 6,00 $ -

×

WIM HOF Live Online Experience 2018 - Wim Hof

1 × 5,00 $

WIM HOF Live Online Experience 2018 - Wim Hof

1 × 5,00 $ -

×

Beyond Self Hypnosis 2020 (full version) with Igor Ledochowski

1 × 39,00 $

Beyond Self Hypnosis 2020 (full version) with Igor Ledochowski

1 × 39,00 $ -

×

Ascension Mystery School 3.0: Gateway to Galactic Mind with David Wilcock

1 × 46,00 $

Ascension Mystery School 3.0: Gateway to Galactic Mind with David Wilcock

1 × 46,00 $ -

×

Creating Seamless Textures in Photoshop with Stone River eLearning

1 × 6,00 $

Creating Seamless Textures in Photoshop with Stone River eLearning

1 × 6,00 $ -

×

SHIFT by Julien Blanc

1 × 5,00 $

SHIFT by Julien Blanc

1 × 5,00 $ -

×

Account Monitoring and Warning Signs with Scott Powell - CFI Education

1 × 15,00 $

Account Monitoring and Warning Signs with Scott Powell - CFI Education

1 × 15,00 $ -

×

Irvin Yalom on Grief, Loss, and Growing Old

1 × 8,00 $

Irvin Yalom on Grief, Loss, and Growing Old

1 × 8,00 $ -

×

P90X with Tony Horton

1 × 5,00 $

P90X with Tony Horton

1 × 5,00 $ -

×

The Woman’s Vitality Summit

1 × 5,00 $

The Woman’s Vitality Summit

1 × 5,00 $ -

×

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $ -

×

Start to Finish - Brutal Violent Dubstep with Dan Larsson

1 × 15,00 $

Start to Finish - Brutal Violent Dubstep with Dan Larsson

1 × 15,00 $ -

×

Money Doubler with Glynn Kosky

1 × 5,00 $

Money Doubler with Glynn Kosky

1 × 5,00 $ -

×

GMBs Verification 2024

1 × 5,00 $

GMBs Verification 2024

1 × 5,00 $ -

×

How to Make Your Podcast Sound Great with Ray Ortega

1 × 5,00 $

How to Make Your Podcast Sound Great with Ray Ortega

1 × 5,00 $ -

×

6 Figure Promotions with Tej Dosa

1 × 15,00 $

6 Figure Promotions with Tej Dosa

1 × 15,00 $ -

×

The Truth About Cancer Eastern Medicine – Gold Edition

1 × 23,00 $

The Truth About Cancer Eastern Medicine – Gold Edition

1 × 23,00 $ -

×

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $ -

×

Mole Richardson Wind Machine Fan 3D Model with PRO EDU

1 × 8,00 $

Mole Richardson Wind Machine Fan 3D Model with PRO EDU

1 × 8,00 $ -

×

Taoist Breathing 2022 Summer Retreat (Two Weeks) with Bruce Frantzis

1 × 155,00 $

Taoist Breathing 2022 Summer Retreat (Two Weeks) with Bruce Frantzis

1 × 155,00 $ -

×

Media Buyer’s Toolkit

1 × 5,00 $

Media Buyer’s Toolkit

1 × 5,00 $ -

×

Gut Health Makeover with Kim Foster

1 × 179,00 $

Gut Health Makeover with Kim Foster

1 × 179,00 $ -

×

Learning to Light Day Exteriors with Shane Hurlbut

1 × 8,00 $

Learning to Light Day Exteriors with Shane Hurlbut

1 × 8,00 $ -

×

Shamanic Rituals to Embody the Healing Power of Spirit Animals - Puma Fredy Quispe Singona - The Shift Network

1 × 54,00 $

Shamanic Rituals to Embody the Healing Power of Spirit Animals - Puma Fredy Quispe Singona - The Shift Network

1 × 54,00 $ -

×

HUMAN MECHANICS ONLINE 10 WEEK COURSE with Mads Tömörkènyi

1 × 5,00 $

HUMAN MECHANICS ONLINE 10 WEEK COURSE with Mads Tömörkènyi

1 × 5,00 $ -

×

Half Guard: sweeps and submissions with André Monteiro

1 × 6,00 $

Half Guard: sweeps and submissions with André Monteiro

1 × 6,00 $ -

×

How I make $15K+ per week with Simple Software - Secret Marketer

1 × 5,00 $

How I make $15K+ per week with Simple Software - Secret Marketer

1 × 5,00 $ -

×

Blocking & Lighting A-Z with Shane Hurlbut

1 × 8,00 $

Blocking & Lighting A-Z with Shane Hurlbut

1 × 8,00 $ -

×

KPI Profit Blueprint with Matt Larson

1 × 69,00 $

KPI Profit Blueprint with Matt Larson

1 × 69,00 $ -

×

3-Day Dialectical Behavior Therapy Certification Training by Lane Pederson

1 × 31,00 $

3-Day Dialectical Behavior Therapy Certification Training by Lane Pederson

1 × 31,00 $ -

×

Dappled Light Forest Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Dappled Light Forest Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Business by Design: Journey By Unlock Your Design Academy

1 × 23,00 $

Business by Design: Journey By Unlock Your Design Academy

1 × 23,00 $ -

×

The Chad Mindset: Forge an Unbreakable Mental Framework with Jacked Aecus

1 × 5,00 $

The Chad Mindset: Forge an Unbreakable Mental Framework with Jacked Aecus

1 × 5,00 $ -

×

Digital Banking Fundamentals with Esteban Santana - CFI Education

1 × 15,00 $

Digital Banking Fundamentals with Esteban Santana - CFI Education

1 × 15,00 $ -

×

Isle of Skye Rolling Seaside Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Isle of Skye Rolling Seaside Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Sixty Years of Challenge - More Numbers, Less Flakes

1 × 5,00 $

Sixty Years of Challenge - More Numbers, Less Flakes

1 × 5,00 $ -

×

SEO That Works 4.0 with Brian Dean

1 × 5,00 $

SEO That Works 4.0 with Brian Dean

1 × 5,00 $ -

×

EXSTORE Orthopedic System Online Training - Anthony Lombardi

1 × 389,00 $

EXSTORE Orthopedic System Online Training - Anthony Lombardi

1 × 389,00 $ -

×

Classic jiu-jitsu with Mauricio Gomes

1 × 6,00 $

Classic jiu-jitsu with Mauricio Gomes

1 × 6,00 $ -

×

Make Compelling Videos That Go Viral - Marques Brownlee

1 × 6,00 $

Make Compelling Videos That Go Viral - Marques Brownlee

1 × 6,00 $ -

×

Investishare – Bundle 3 Courses

1 × 5,00 $

Investishare – Bundle 3 Courses

1 × 5,00 $

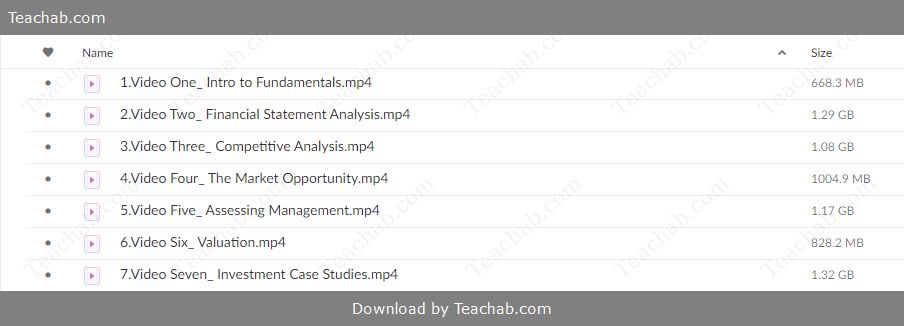

Introduction To Fundamental Investing with Invictus Research

599,00 $ Original price was: 599,00 $.34,00 $Current price is: 34,00 $.

SKU: KEB. 45746U0AuHGTB

Category: Finance

Tags: Introduction To Fundamental Investing, Invictus Research

Download Introduction To Fundamental Investing with Invictus Research, check content proof here:

Review of Fundamental Investing Introduction

A common analogy for investing is building a solid foundation; the more robust your foundation, the more durable your structure will be throughout market turbulence and economic downturns. That core information is what Invictus Research’s “Introduction to Fundamental Investing” course seeks to impart, giving both seasoned experts and aspiring investors a strong basis. In order to enable people to confidently and clearly traverse the intricate world of financial markets, this course aims to demystify the art of investing research through a series of captivating films.

Fundamental analysis becomes essential in a world where every investing decision might feel like walking onto a perilous ledge. This course has been carefully designed to incorporate the essential ideas that characterize profitable investing plans. It serves those who are eager to improve their analytical abilities by giving them insights similar to those of experts in the field. Participating in this course is expected to improve one’s capacity to critically assess companies and their management teams in addition to honing investing acumen. This all-encompassing strategy is essential for making wise investment choices and guaranteeing that participants become capable contributors to the financial world.

Key Components of the Course

Understanding Financial Statements

One of the cornerstones of the “Introduction to Fundamental Investing” course is financial statement analysis. This fundamental skill is akin to learning the language of finance, enabling participants to decode the financial health of businesses they might invest in. Financial statements act as a window into a company’s soul, revealing its profitability, liquidity, and operational efficiency.

- Balance Sheet: Offers a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Understanding this document is pivotal in assessing a firm’s financial stability.

- Income Statement: Illustrates the revenue, expenses, and profit over a certain period. Analyzing this can help investors gauge a company’s performance and profitability trajectory.

- Cash Flow Statement: Details the inflows and outflows of cash, providing insights into the company’s liquidity. This statement answers the crucial question: Is the company generating enough cash to meet its obligations?

By mastering these documents, learners can develop a keen eye for spotting potential investment opportunities and risks.

Evaluation of Market Opportunities and Competitive Analysis

Students study competitive analysis and market opportunity evaluation, two pillars that assist well-informed decision-making, in addition to financial statements. Consider them to be the map and compass that help an investor navigate the broad array of market alternatives.

- Analyzing a company’s position in the market in relation to its competitors is known as competitive analysis. Students obtain a thorough grasp of a company’s position in its sector by comprehending strengths, weaknesses, opportunities, and threats, often known as SWOT analysis.

- Evaluation of Market Opportunities: This module gives participants the skills they need to spot new trends and potential investments. Developing successful investing plans requires an understanding of the development potential in different areas.

The Interplay of Macroeconomic Insights and Fundamental Investing

A standout aspect of this educational program is its emphasis on incorporating macroeconomic insights into fundamental investing. This holistic integration ensures that while you might scrutinize a company’s inner workings, you are also aware of the broader economic environment impacting that company’s performance.

- Economic Indicators: Participants learn to analyze indicators such as GDP growth rates, unemployment figures, and inflation. Understanding these data points helps in forecasting market trends and identifying investment risks.

- Market Dynamics: The course teaches how macroeconomic factors influence market behavior, equipping learners to anticipate changes and adjust their investment strategies accordingly.

By merging both fundamental and macro investing techniques, participants develop a comprehensive toolkit, allowing for a richer understanding of market dynamics.

Course Design and Methodology: Using Video Format

The seven well-organized films that make up the course last anywhere from 25 to 50 minutes each. In addition to accommodating different learning styles, this structure makes difficult ideas easy to understand. Participants may interact with the content at their own speed and go back and watch videos as needed.

Real-world examples and case studies are included in the carefully constructed curriculum to encourage active participation and make sure students understand how their studies are applied in the real world. In order to translate theoretical information into practical insights, the course provides pertinent scenarios.

Focus on Practicality and Real-World Application

Another significant attribute of this course is its focus on practical application. For instance, students are encouraged to participate in practical exercises, such as analyzing live market data and applying fundamental analysis techniques in simulated environments.

This hands-on approach not only reinforces learning but also simulates actual investment decision-making scenarios. By the completion of the course, participants are not just armed with knowledge; they possess a confidence that translates to real-world investment environments.

In conclusion

Fundamentally, investing involves making well-informed decisions that might result in either profitable gains or catastrophic losses. For individuals who are keen to learn the nuances of investing research, Invictus Research’s “Introduction to Fundamental Investing” course is a shining example. With its focus on macroeconomic insights, competitive market assessment, and financial statement analysis, this course gives learners the well-rounded viewpoint they need to successfully navigate the investing landscape.

Its captivating structure and emphasis on practical application prepare students to approach investing decisions with confidence and clarity. This course is the perfect place to start if you’re a beginner trying to get into investing or an experienced investor wishing to hone your analytical abilities. In the end, it’s not only about the numbers on a balance sheet; it’s also about comprehending the narrative those figures convey, which can help you create a solid investment portfolio that can endure any market storm.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Introduction To Fundamental Investing with Invictus Research” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.