Loan Covenants with Tim Vipond – CFI Education

15,00 $

You may check content proof of “Loan Covenants with Tim Vipond – CFI Education” below:

Review of Loan Covenants – Tim Vipond

Loan covenants are paramount in the lending landscape, serving as essential frameworks that protect the interests of both lenders and borrowers. Tim Vipond, an influential figure in this domain, has significantly contributed to our understanding of loan covenants through his comprehensive educational resources and analyses. As chair of the board of CFI Education, Vipond emphasizes not only the educational aspects but also the practical application of these agreements in real-world scenarios.

In his insightful course on loan covenants, he deciphers critical concepts such as different types of covenants, the implications of breaches, and the financial metrics pivotal for assessing compliance. This article aims to provide a detailed review of Tim Vipond’s work on loan covenants, illustrating the fundamental principles and practical applications as they relate to borrowers and lenders.

Understanding Loan Covenants

Loan covenants can be understood as agreements between a borrower and a lender that stipulate specific behavioral expectations the borrower must meet. They can be likened to a tightrope act in a circus balancing on that thin line requires skill and discipline, and any misstep could lead to a significant downfall. By laying out explicit requirements, loan covenants help create a secure environment for both parties. They act as guidelines that borrowers should adhere to in order to maintain a satisfactory level of financial health.

Vipond elucidates that these covenants are not merely binding contracts; they are essential tools in the lending process. They provide a safety net for lenders who want assurance that their borrowers are managing their financial obligations responsibly. With this in mind, it’s important to understand the different types of loan covenants, which can broadly be categorized as affirmative and negative covenants.

- Affirmative Covenants: These are obligations that borrowers must comply with. For instance, maintaining certain insurance levels or providing regular financial statements.

- Negative Covenants: These restrict specific actions that borrowers may undertake, such as incurring additional debt or selling key assets without lender consent.

By differentiating these covenants, Vipond allows aspiring credit analysts and borrowers to analyze and appreciate the nuances and implications associated with each type. He demonstrates that a clear understanding of these agreements can foster healthier relationships between borrowers and lenders, ultimately enhancing the integrity of the financial system as a whole.

Implications of Covenant Breaches

When a borrower fails to meet the outlined conditions, it constitutes a breach of covenant that could trigger severe consequences. The implications of such breaches can be catastrophic, much like a boat sailing off its designated path during a storm. Tim Vipond’s analysis of covenant breaches reveals that lenders may resort to various measures when a borrower defaults on their obligations. These consequences may include the imposition of penalties, increased interest rates, or even loan acceleration where the full outstanding amount becomes payable immediately.

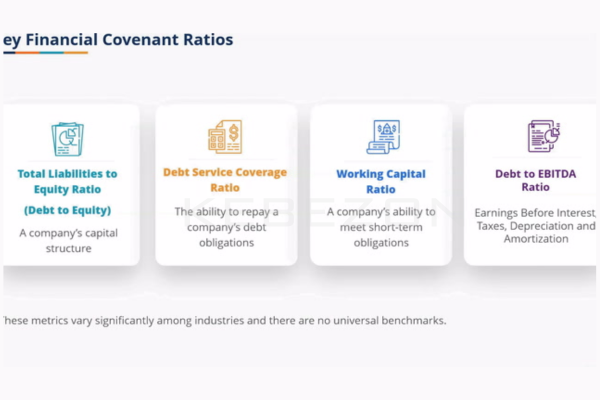

Understanding the repercussions of failing to comply with loan covenants is critical for borrowers. They must appreciate that these financial agreements are not mere formalities, but rather contracts designed to safeguard financial health and creditworthiness. Two key metrics often emphasized by Vipond include:

- Debt-to-equity ratio: This ratio indicates the relative proportion of funds borrowed against funds contributed by shareholders. A high ratio signifies higher risk, which may trigger covenant restrictions.

- Interest coverage ratio: This metric measures the borrower’s ability to pay interest on outstanding debt. A low ratio can signal distress, prompting lenders to take action.

Borrowers are encouraged to regularly monitor these ratios to ensure they remain in compliance. By doing so, they can avoid unnecessary disputes and cultivate better relationships with their lenders, thereby reducing the likelihood of financial turmoil.

Practical Insights for Aspiring Credit Analysts

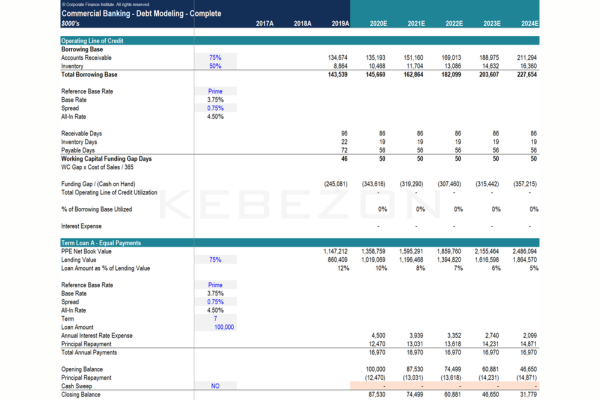

Tim Vipond’s practical insights for aspiring credit analysts are invaluable for navigating the complexities of loan covenant analysis. His focus on real-world application is akin to a seasoned navigator guiding a ship through treacherous waters. He emphasizes the significance of financial modeling, particularly through tools such as Excel, to assess compliance with covenants effectively.

Financial modeling is integral to understanding how various scenarios can impact covenant obligations and overall financial health. Vipond provides a practical framework that allows analysts to simulate different conditions and stress-test borrower profiles against covenant requirements. For example, an analyst might create a model that adjusts a borrower’s projected revenues and expenses under differing economic conditions to observe how these changes affect compliance metrics.

Key Elements in Financial Modeling

- Data Collection: Gathering historical financial data and projected trends.

- Scenario Planning: Creating various financial scenarios (best-case, worst-case, and most likely) to analyze how they would influence covenant compliance.

- Output Analysis: Evaluating the results to determine actionable insights for borrowers and lenders alike.

Vipond’s teachings emphasize the responsibility of borrowers to fully understand these agreements. By equipping themselves with the right tools and knowledge, borrowers not only support their financial stability but also foster a culture of transparency and trust with their lenders.

The Importance of Educational Resources

The educational resources provided by Tim Vipond are instrumental in demystifying the complex landscape of loan covenants. He takes a subject often perceived as dry and dense and transforms it into an engaging and impactful learning experience. Vipond’s commitment to education ensures that both aspiring credit analysts and seasoned professionals can navigate these intricate agreements with ease. Through detailed case studies, examples, and clear explanations, he illustrates how theoretical and practical aspects intertwine seamlessly.

Moreover, the covenant landscape is not static; it evolves as financial markets fluctuate and regulatory frameworks shift. Therefore, ongoing education is essential for all stakeholders involved. Vipond’s contributions, encapsulated in his writings, offer a roadmap for continuous learning that encourages borrowers and lenders to stay abreast of changes in the landscape.

Educational Takeaways

- Comprehensive Understanding: Learning the nuances of different types of covenants and their implications helps in risk mitigation.

- Real-World Applications: Analytical skills developed through financial modeling pave the way for informed decision-making.

- Relationship Building: Awareness of borrowing obligations fosters stronger ties with lenders, enhancing trust and transparency.

Through his focus on education, Vipond cultivates a better-informed audience that is empowered to make sound financial decisions. Consequently, this contributes positively to the overall stability and resilience of the lending ecosystem.

Concluding Thoughts

In navigating the complexities of loan covenants, Tim Vipond’s contributions have illuminated the often-overlooked nuances and implications of these agreements. By combining theoretical knowledge with practical applications, he provides a comprehensive framework that benefits both borrowers and lenders. His emphasis on understanding and adhering to loan covenants not only protects the interests of lenders but also fosters a responsible borrowing culture.

Ultimately, Vipond’s work encourages continual learning and awareness in the dynamic environment of financial agreements, ensuring that all parties involved can thrive while navigating the intricacies of the lending process. As we look to the future, his insights serve as a guiding light in a complex and ever-evolving financial landscape.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Loan Covenants with Tim Vipond – CFI Education” Cancel reply

You must be logged in to post a review.

Related products

Finance

Reviews

There are no reviews yet.