-

×

How To Get Your Clients To Send You More Clients with Maria Wendt

1 × 5,00 $

How To Get Your Clients To Send You More Clients with Maria Wendt

1 × 5,00 $ -

×

Schema therapy step by step - Remco van der Wijngaart and Hannie van Genderen

1 × 39,00 $

Schema therapy step by step - Remco van der Wijngaart and Hannie van Genderen

1 × 39,00 $ -

×

Musicality & Interpretation. Tell Your Own Tango Story with CARLOS ESPINOZA & NOELIA HURTADO

1 × 54,00 $

Musicality & Interpretation. Tell Your Own Tango Story with CARLOS ESPINOZA & NOELIA HURTADO

1 × 54,00 $ -

×

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $ -

×

New Workout Program with Caliathletics

1 × 5,00 $

New Workout Program with Caliathletics

1 × 5,00 $ -

×

GMBs Verification 2024

1 × 5,00 $

GMBs Verification 2024

1 × 5,00 $ -

×

Intelligent Index Investing with Cassandra Cummings

1 × 23,00 $

Intelligent Index Investing with Cassandra Cummings

1 × 23,00 $ -

×

The Art Of Shaping Hard Light with Jason Buff

1 × 8,00 $

The Art Of Shaping Hard Light with Jason Buff

1 × 8,00 $ -

×

My Amazon Guy Success Academy with MAG School

1 × 29,00 $

My Amazon Guy Success Academy with MAG School

1 × 29,00 $ -

×

Wall Street Prep Financial Modeling Course

1 × 5,00 $

Wall Street Prep Financial Modeling Course

1 × 5,00 $ -

×

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $ -

×

Ecommerce Brand Academy with Cody Neer

1 × 23,00 $

Ecommerce Brand Academy with Cody Neer

1 × 23,00 $ -

×

Rapid Escalation by Liam McRae

1 × 5,00 $

Rapid Escalation by Liam McRae

1 × 5,00 $ -

×

Dominate: Conquer your fears (Become the man you want to be) - David De Las Morenas

1 × 5,00 $

Dominate: Conquer your fears (Become the man you want to be) - David De Las Morenas

1 × 5,00 $ -

×

Mystery's Bundle - Hey Guys! Audiobook + eBooks Hey Guys! and Book of Negs by Ask Mystery

1 × 15,00 $

Mystery's Bundle - Hey Guys! Audiobook + eBooks Hey Guys! and Book of Negs by Ask Mystery

1 × 15,00 $ -

×

Build and Sell APIs – Establish a New Income Stream!

1 × 5,00 $

Build and Sell APIs – Establish a New Income Stream!

1 × 5,00 $ -

×

A Maze of Problems! - Success Tips By Ready2Go Marketing Solutions

1 × 15,00 $

A Maze of Problems! - Success Tips By Ready2Go Marketing Solutions

1 × 15,00 $ -

×

Quora Cash Cow : Automated System to Cultivate Your Quora Earnings - Sean Kernan

1 × 5,00 $

Quora Cash Cow : Automated System to Cultivate Your Quora Earnings - Sean Kernan

1 × 5,00 $ -

×

Blocking & Lighting A-Z with Shane Hurlbut

1 × 8,00 $

Blocking & Lighting A-Z with Shane Hurlbut

1 × 8,00 $ -

×

Power of 2 Marriage Skills Workshop with Susan Heitler & Abigail Hirsch

1 × 8,00 $

Power of 2 Marriage Skills Workshop with Susan Heitler & Abigail Hirsch

1 × 8,00 $ -

×

CRUX Blueprint – Get My Brand with Tony Shepherd

1 × 5,00 $

CRUX Blueprint – Get My Brand with Tony Shepherd

1 × 5,00 $ -

×

Great Masters: Liszt-His Life and Music with Robert Greenberg

1 × 5,00 $

Great Masters: Liszt-His Life and Music with Robert Greenberg

1 × 5,00 $ -

×

Precision Nutrition - How to Fix a Broken Diet + Intermittent Fasting - John Berardi

1 × 5,00 $

Precision Nutrition - How to Fix a Broken Diet + Intermittent Fasting - John Berardi

1 × 5,00 $ -

×

The Last eCom Course with Justing Phillips

1 × 27,00 $

The Last eCom Course with Justing Phillips

1 × 27,00 $ -

×

Clear & Cleanse L1, L2 & L3 Pain Body (Advanced) with Spirituality Zone

1 × 15,00 $

Clear & Cleanse L1, L2 & L3 Pain Body (Advanced) with Spirituality Zone

1 × 15,00 $ -

×

10 Part Business Start with Michael Sasser

1 × 23,00 $

10 Part Business Start with Michael Sasser

1 × 23,00 $ -

×

The Search for Exoplanets: What Astronomers Know with Joshua Winn

1 × 5,00 $

The Search for Exoplanets: What Astronomers Know with Joshua Winn

1 × 5,00 $ -

×

SEO That Works 4.0 with Brian Dean

1 × 5,00 $

SEO That Works 4.0 with Brian Dean

1 × 5,00 $ -

×

Conversation Power: Communication for Business and Personal Success with James Fleet

1 × 5,00 $

Conversation Power: Communication for Business and Personal Success with James Fleet

1 × 5,00 $ -

×

SSL Sniper with Tom Gaddis and Nick Ponte

1 × 5,00 $

SSL Sniper with Tom Gaddis and Nick Ponte

1 × 5,00 $ -

×

The Inner Dimensions of Mastering Money by Tami Simon

1 × 31,00 $

The Inner Dimensions of Mastering Money by Tami Simon

1 × 31,00 $ -

×

Your Easy Phone Money Membership

1 × 5,00 $

Your Easy Phone Money Membership

1 × 5,00 $ -

×

The MMXM Trader – Personal Approach

1 × 5,00 $

The MMXM Trader – Personal Approach

1 × 5,00 $ -

×

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $ -

×

Tantra Cure for Premature Ejaculation

1 × 5,00 $

Tantra Cure for Premature Ejaculation

1 × 5,00 $ -

×

The Winds Of Change with Arash Dibazar

1 × 5,00 $

The Winds Of Change with Arash Dibazar

1 × 5,00 $ -

×

Smart Product Creation with John Grimshaw

1 × 27,00 $

Smart Product Creation with John Grimshaw

1 × 27,00 $ -

×

Inboxlab.io Program by Jimmy Fung

1 × 5,00 $

Inboxlab.io Program by Jimmy Fung

1 × 5,00 $ -

×

Programmatic SEO X ChatGPT to 10x Website Traffic in 6-9 Months - Surdeep Singh

1 × 5,00 $

Programmatic SEO X ChatGPT to 10x Website Traffic in 6-9 Months - Surdeep Singh

1 × 5,00 $ -

×

Beyond Self Hypnosis 2020 (full version) with Igor Ledochowski

1 × 39,00 $

Beyond Self Hypnosis 2020 (full version) with Igor Ledochowski

1 × 39,00 $ -

×

Yoga, Ayurveda, Mantra & Meditation Course with Vamadeva Shastri

1 × 101,00 $

Yoga, Ayurveda, Mantra & Meditation Course with Vamadeva Shastri

1 × 101,00 $ -

×

The Urban Monk with Pedram Shojai

1 × 5,00 $

The Urban Monk with Pedram Shojai

1 × 5,00 $ -

×

How to Build Your Own Online Business with WordPress - Stone River eLearning

1 × 6,00 $

How to Build Your Own Online Business with WordPress - Stone River eLearning

1 × 6,00 $ -

×

7-STEP VIDEO TOOLKIT - SIDEHUSTLE NINJA PRO

1 × 5,00 $

7-STEP VIDEO TOOLKIT - SIDEHUSTLE NINJA PRO

1 × 5,00 $ -

×

Data Extraction with Chris Mercer

1 × 39,00 $

Data Extraction with Chris Mercer

1 × 39,00 $ -

×

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $ -

×

Hidden Woodland Beaches And Waterfalls Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Hidden Woodland Beaches And Waterfalls Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

TikTok Shop Playbook with Ecom Degree University

1 × 5,00 $

TikTok Shop Playbook with Ecom Degree University

1 × 5,00 $ -

×

Landing The Big Fish + Email Playbook with Kyle Milligan & John Grimes

1 × 5,00 $

Landing The Big Fish + Email Playbook with Kyle Milligan & John Grimes

1 × 5,00 $ -

×

The Growth Accelerator with Dan Martell

1 × 5,00 $

The Growth Accelerator with Dan Martell

1 × 5,00 $ -

×

Credit Administration and Documentation with Scott Powell - CFI Education

1 × 15,00 $

Credit Administration and Documentation with Scott Powell - CFI Education

1 × 15,00 $ -

×

Inner View 2023 with Debra Silverman Astrology

1 × 85,00 $

Inner View 2023 with Debra Silverman Astrology

1 × 85,00 $ -

×

Mastering Influence – Boost Your Influential Power And Exceed Your Sales Goals (2021) - Tony Robbins

1 × 5,00 $

Mastering Influence – Boost Your Influential Power And Exceed Your Sales Goals (2021) - Tony Robbins

1 × 5,00 $ -

×

Light Painting for Beginners with Ben Willmore

1 × 6,00 $

Light Painting for Beginners with Ben Willmore

1 × 6,00 $ -

×

Fund Your Purpose Program by Peter Diamandis

1 × 171,00 $

Fund Your Purpose Program by Peter Diamandis

1 × 171,00 $ -

×

Boss Traffic with Fergal Downes

1 × 5,00 $

Boss Traffic with Fergal Downes

1 × 5,00 $ -

×

Read The Market RTM Master Trader Course + Journals

1 × 5,00 $

Read The Market RTM Master Trader Course + Journals

1 × 5,00 $ -

×

AI Client Goldmine with Offline Sharks

1 × 5,00 $

AI Client Goldmine with Offline Sharks

1 × 5,00 $ -

×

YouTube Title Mastery Recordings By Jake Thomas - Creator Hooks

1 × 5,00 $

YouTube Title Mastery Recordings By Jake Thomas - Creator Hooks

1 × 5,00 $ -

×

Elite POD Course + Playbook with Jesse Anselm

1 × 26,00 $

Elite POD Course + Playbook with Jesse Anselm

1 × 26,00 $ -

×

Super Learning Master Class with Howard Berg

1 × 5,00 $

Super Learning Master Class with Howard Berg

1 × 5,00 $ -

×

How to Teach a Craft Class with Ashley Nickels

1 × 5,00 $

How to Teach a Craft Class with Ashley Nickels

1 × 5,00 $ -

×

Formatting Print Books and eBooks Using Adobe InDesign - Mandi Lynn

1 × 23,00 $

Formatting Print Books and eBooks Using Adobe InDesign - Mandi Lynn

1 × 23,00 $ -

×

Thriller Software Add-On with John Truby

1 × 23,00 $

Thriller Software Add-On with John Truby

1 × 23,00 $ -

×

SHIFT by Julien Blanc

1 × 5,00 $

SHIFT by Julien Blanc

1 × 5,00 $

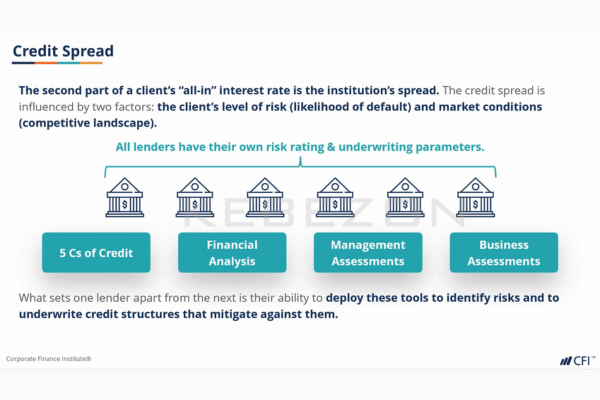

Loan Pricing with Kyle Peterdy – CFI Education

15,00 $

You may check content proof of “Loan Pricing with Kyle Peterdy – CFI Education” below:

Loan Pricing: Insights from Kyle Peterdy

In the ever-evolving realm of finance, understanding the delicate tapestry of loan pricing serves as a cornerstone for success. The loan pricing course led by Kyle Peterdy at the Corporate Finance Institute (CFI) offers a comprehensive guide to navigating this intricate field. This course does not merely skim the surface but delves into the core principles and methodologies that shape loan pricing decisions. From interest rates to loan structures, participants are immersed in both theoretical frameworks and practical applications, allowing them to emerge with the knowledge necessary to thrive in a competitive market.

By engaging in a blend of rigorous content, interactive case studies, and real-world applications, learners can connect the dots between theory and practice. This article explores the course’s key components, evaluates its significance in the commercial banking world, and presents insights that could benefit industry professionals looking to sharpen their expertise in loan pricing strategies.

The Fundamentals of Loan Pricing

At the heart of the loan pricing course lies an in-depth exploration of the fundamentals that dictate loan pricing decisions. This section of the course encapsulates various critical topics that include the nuanced relationships between interest rates, loan structures, and the profitability metrics that banks use to establish loan prices.

Understanding Interest Rates

Interest rates act as the lifeblood of loan pricing, influencing everything from borrower demand to risk assessment. In the course, participants gain a nuanced understanding of how these rates are determined.

For instance, fixed vs. variable rates are discussed in detail:

- Fixed rates provide stability for borrowers, insulating them from fluctuations in market conditions.

- Variable rates, however, allow lenders to adjust in response to market shifts, potentially increasing profitability over time.

The selection between these types hinges on not only market forecasts but also on the borrower’s risk profile and the competitive landscape.

Types of Loans and Their Profitability

The loan pricing course also delves into the various types of loans ranging from personal loans and mortgages to business loans and discusses their profitability. Through meticulous comparisons, participants learn how each loan type can be effectively priced based on its unique characteristics and risk factors.

A summary of common loan types and associated profitability considerations includes:

| Loan Type | Profitability Factors | Risk Considerations |

| Personal Loans | Interest rates, fees | Borrower’s creditworthiness |

| Mortgages | Long-term interest income, fees | Market volatility, default risk |

| Business Loans | Return on investment (ROI), collateral | Business sector exposure |

This framework equips learners with the tools necessary to select optimal pricing strategies tailored to diverse client needs.

Risk-Adjusted Returns on Capital

A significant emphasis of the course is placed on understanding risk-adjusted returns on capital. This concept not only incorporates interest rates but also integrates risk assessment into the profitability conversation, guiding banks in making informed lending decisions.

In practical terms, this involves analyzing default risks associated with different borrowers. As participants progress through the course, they’ll explore methodologies for quantifying risks and subsequently adjusting pricing strategies accordingly. These insights allow them to craft offerings that reflect both the reward of lending and the associated risks.

Practical Application Through Case Studies

One of the standout features of the loan pricing course is its focus on interactive case studies, which provide participants with hands-on experience related to loan pricing and profitability analysis. This practical approach fosters a deeper understanding of the course content while allowing learners to engage with real-world scenarios.

Real-World Scenarios

In these case studies, learners are often presented with a scenario where they must evaluate a client’s financial situation. They assess the risks involved and iterate potential pricing models based on the gathered intelligence. For instance, a case study might examine a small business seeking a loan during an economic downturn.

Participants are prompted to consider:

- The business’s revenue stability,

- Market competition,

- The economic forecasts affecting the industry.

By synthesizing these factors, learners can develop pricing strategies that balance profitability with risk mitigation, ensuring that the bank remains competitive while minimizing exposure to defaults.

Importance of Risk-Based Approach

The emphasis on a risk-based approach is a crucial pillar of the course. Understanding that not all borrowers are created equal allows lending professionals to tailor their offers. Thus, considerations of costs, risks, and profits meld into a coherent strategy that maximizes value.

For instance, differentiating between high-risk and low-risk borrowers could lead a financial institution to adopt varying pricing structures. Low-risk clients may receive better rates as a means to foster long-term relationships, while high-risk entities might incur higher rates to compensate for the increased risk.

Skills for Commercial Banking Professionals

Ultimately, the loan pricing course aims to equip commercial banking and lending professionals such as relationship managers and credit analysts with the skills necessary for effective client evaluation and optimal pricing strategy development. This course does more than impart knowledge; it imbues participants with confidence through practical application.

Developing Optimal Pricing Strategies

As professionals refine their skills, they learn to identify various profitability factors essential for loan pricing. Their training emphasizes:

- Cost analysis: Understanding overheads and operational expenditures.

- Risk appraisal: Quantifying and categorizing risks associated with diverse loan offerings.

- Market conditions: Keeping abreast of economic indicators that could influence interest rates and default risks.

These insights empower participants to synthesize information into actionable strategies that align with their institution’s goals and their clients’ needs.

Evaluating Client Default Risk

Furthermore, understanding and evaluating a client’s default risk is integral to effective loan pricing. This is not just about assessing historical data; it requires an empathetic understanding of the client’s context. Acknowledging external factors such as industry trends and economic cycles enables learners to make informed predictions about potential risks.

By viewing the client not merely as a number but as a complex entity impacted by various forces, learners gain a holistic perspective that aids in crafting effective pricing solutions.

Conclusion

In summary, the loan pricing course by Kyle Peterdy at CFI serves as a vital resource for those aspiring to enhance their expertise in the banking and finance industry, particularly in loan pricing methodology. Participants emerge with a deeper understanding of the intricate landscape of interest rates, loan structures, and risk assessment. They learn to navigate the complexities of developing pricing strategies that are not only profitable but also reflective of the myriad risks involved.

In an industry where every decision counts, the course equips learners with the skills, knowledge, and confidence needed to make astute loan pricing decisions that can ultimately shape their professional trajectories. With the right tools and insights, they can ensure that their institutions thrive in an increasingly competitive marketplace.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Loan Pricing with Kyle Peterdy – CFI Education” Cancel reply

You must be logged in to post a review.

Related products

Finance

Finance

Reviews

There are no reviews yet.