-

×

Character Design Fundamentals with Emma Gillette

1 × 46,00 $

Character Design Fundamentals with Emma Gillette

1 × 46,00 $ -

×

AI Email Academy And Advertorial Mastery with Zarak

1 × 27,00 $

AI Email Academy And Advertorial Mastery with Zarak

1 × 27,00 $ -

×

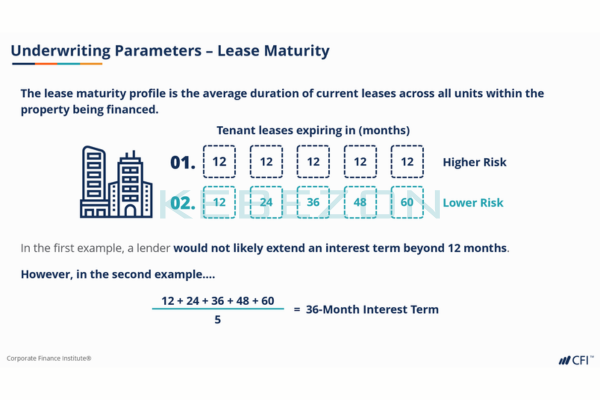

Real Estate Fundamentals - Kyle Peterdy - CFI Education

1 × 15,00 $

Real Estate Fundamentals - Kyle Peterdy - CFI Education

1 × 15,00 $ -

×

Psychiatric Diagnosis and Interviewing with Jason Buckles & Victor Yalom

1 × 8,00 $

Psychiatric Diagnosis and Interviewing with Jason Buckles & Victor Yalom

1 × 8,00 $ -

×

Marketing Mastery to RaiseUp Your Business by Kami Guildner

1 × 93,00 $

Marketing Mastery to RaiseUp Your Business by Kami Guildner

1 × 93,00 $ -

×

xShot Email Method Course

1 × 5,00 $

xShot Email Method Course

1 × 5,00 $ -

×

Seas And Waves Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Seas And Waves Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Mysterious Techniques That Will Spike Her Attraction by Arash Dibazar

1 × 5,00 $

Mysterious Techniques That Will Spike Her Attraction by Arash Dibazar

1 × 5,00 $

Loan Security with Scott Powell – CFI Education

15,00 $

You may check content proof of “Loan Security with Scott Powell – CFI Education” below:

A Review of Loan Security – Scott Powell

Loan security is an essential aspect of finance that plays a critical role in protecting lenders against potential defaults and fostering a sense of trust in the borrowing process. Scott Powell, an esteemed expert in the field, brings over 25 years of experience to his teachings at the Corporate Finance Institute (CFI).

His dedication to expanding financial literacy is evident in his course titled “Loan Security,” which covers a wide array of topics regarding collateral and the various assets associated with loans. This article aims to provide a comprehensive review of the loan security concepts introduced by Powell, diving into his methodologies, insights, and the significance of understanding loan security in today’s financial landscape.

Understanding Loan Security

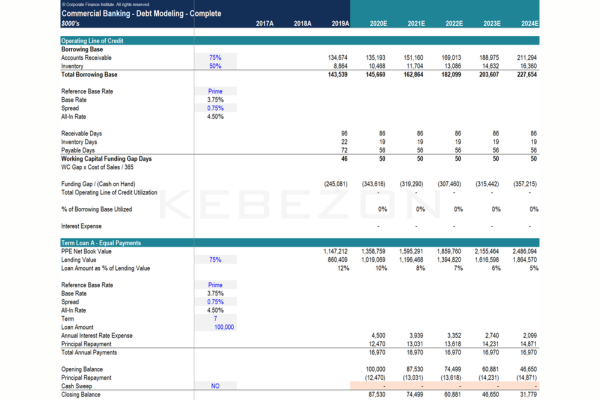

Loan security refers to the collateral that a borrower offers to secure a loan. This collateral can be in various forms, such as real estate, equipment, or accounts receivable. In Scott Powell’s course, he delves into the nuances of this concept, bringing clarity to its importance in commercial banking and credit administration. Imagine a safety net that catches both the lender and the borrower, providing stability and confidence in financial transactions. Effective loan security mitigates risks, making it easier for lenders to operate while offering borrowers access to necessary funds.

Powell emphasizes the critical aspect of evaluating loan security – the value of the assets used as collateral. This evaluation process is akin to a delicate balance, where lenders must carefully assess the worth of the collateral versus the loan amount. If the collateral’s value is underestimated, lenders may face significant losses in the event of default; conversely, overestimating value can lead to tighter lending practices and fewer opportunities for borrowers. Powell unpacks these dilemmas within his course, equipping students with the analytical tools to navigate through these complexities with ease.

Understanding different types of security is not only essential for lenders but also crucial for borrowers. They need to recognize what assets can be leveraged to improve their chances of loan approval. Powell’s course navigates through the layers of loan security, unraveling the types of collaterals, their valuation methods, and the legalities associated with them. By dissecting these components, participants gain a robust framework that fosters informed decision-making a necessity in the intricate world of finance.

Various Types of Loan Security

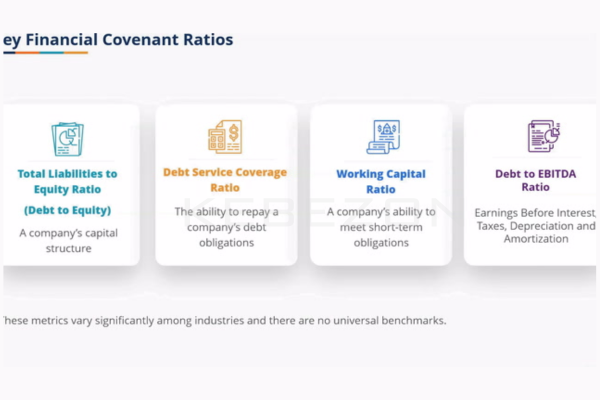

When discussing loan security, Powell categorizes assets into several distinct types, each with unique implications and value assessments. The following table illustrates some of the most common types of collateral:

| Type of Security | Description | Typical Uses | Risks Involved |

| Real Estate | Physical properties, such as homes or buildings | Mortgages, construction loans | Fluctuating market values, legal issues |

| Equipment | Machinery, vehicles, or operational tools | Equipment financing | Depreciation, obsolescence |

| Inventory | Goods held for sale or production | Working capital loans | Market demand variability |

| Accounts Receivable | Money owed by customers for goods/services | Operating lines of credit | Company default risk |

| Stocks and Bonds | Financial securities with market value | Personal loans, business loans | Market volatility, liquidity concerns |

By understanding these distinctive types of loan security, lenders can better mitigate risks while providing favorable terms to borrowers. Not only does this knowledge enhance the borrowing process, but it also contributes to the overall health of the financial system, fostering economic growth.

In Powell’s course, he highlights the acceleration of connection between asset types and their potential security value. For example, real estate traditionally holds more weight because it tends to appreciate over time, while inventories may diminish in value quickly. Therefore, lenders can make more informed decisions based on the collateral they are offered.

The Importance of Valuation Techniques

A core component of Powell’s teachings focuses on the valuation techniques utilized to determine the worth of collateral. Valuation serves as the compass guiding lenders through the treacherous waters of financial transactions, providing a roadmap to understanding how much loan security can be reliably offered.

Different methodologies are employed in determining the value of assets. These can include:

- Market Approach: Analyzing how similar assets have been valued in the marketplace.

- Cost Approach: Estimating how much it would cost to replace the asset.

- Income Approach: Considering the future income the asset may generate.

Powell’s course outlines the strengths and weaknesses of each method, illustrating that the right approach varies depending on the circumstances surrounding the asset. Choosing an incorrect valuation technique could lead to severe repercussions, such as inadequate loan coverage or financial losses for both parties involved.

The intricacies of these methodologies raise a poignant realization: valuing assets is not just a mathematical exercise but a blend of art and science, requiring intuition, market knowledge, and analytical skills. As Scott Powell emphasizes throughout his teachings, an understanding of these valuation techniques arms financial professionals with the confidence to make prudent decisions, aligning risk and reward in a dynamic market.

Assessing Risks in Loan Security

Identifying and assessing risks associated with loan security is an essential area that Scott Powell addresses in depth. It’s not just about numbers; it’s about understanding the market environment, the borrower’s circumstances, and the broader financial landscape. Risks can be classified into various categories:

- Market Risk: Changes in the economic environment that affect asset value.

- Credit Risk: The possibility of borrower default.

- Liquidity Risk: Difficulty in selling the asset to recover funds.

- Legal Risk: Potential legal complications arising from collateral claims.

Each risk type weaves into a tapestry of considerations that lenders must traverse. Powell educates students on the importance of conducting thorough due diligence and implementing risk mitigation strategies to safeguard their interests. For instance, in times of economic downturn, assets like real estate might depreciate, affecting the overall collateral’s value. Recognizing these potential pitfalls allows lenders to establish better lending terms and promote healthier financial practices.

By familiarizing themselves with these risks, financial professionals gain valuable insights into how to structure loans effectively. Powell’s experience and teachings are invaluable for stakeholders wanting to understand the delicate balance between risk management and enhancing lending opportunities.

Conclusion

In summary, Scott Powell’s contributions to the topic of loan security are significant, offering financial professionals the knowledge they need to navigate this complex landscape effectively. His course at the Corporate Finance Institute emphasizes the importance of understanding collateral types, valuation techniques, and risk assessment in the lending process.

By equipping learners with robust analytical tools and insights, Powell not only enhances financial literacy but also fosters a more resilient and adaptable financial ecosystem. Understanding loan security is imperative for anyone seeking to thrive in the financial sector, and Scott Powell’s wisdom serves as an essential beacon in this journey.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Loan Security with Scott Powell – CFI Education” Cancel reply

You must be logged in to post a review.

Related products

Finance

Reviews

There are no reviews yet.