-

×

Advanced Overage Bootcamp - All Things Overages

1 × 209,00 $

Advanced Overage Bootcamp - All Things Overages

1 × 209,00 $ -

×

Courageous Coaching Certification with Kendall SummerHawk

1 × 54,00 $

Courageous Coaching Certification with Kendall SummerHawk

1 × 54,00 $ -

×

Deep Connections with George Hutton

1 × 11,00 $

Deep Connections with George Hutton

1 × 11,00 $ -

×

Positive Psychology and Psychotherapy with Martin Seligman

1 × 8,00 $

Positive Psychology and Psychotherapy with Martin Seligman

1 × 8,00 $ -

×

Marketing Mastery to RaiseUp Your Business by Kami Guildner

1 × 93,00 $

Marketing Mastery to RaiseUp Your Business by Kami Guildner

1 × 93,00 $ -

×

Edges For Ledges 2 with Trader Dante

1 × 5,00 $

Edges For Ledges 2 with Trader Dante

1 × 5,00 $ -

×

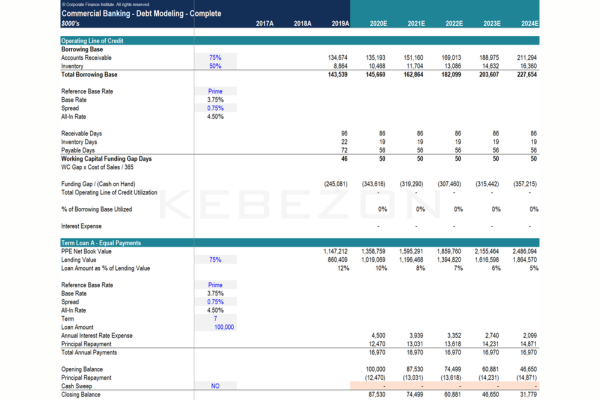

Commercial Banking - Debt Modeling with Tim Vipond - CFI Education

1 × 15,00 $

Commercial Banking - Debt Modeling with Tim Vipond - CFI Education

1 × 15,00 $ -

×

The Urban Monk with Pedram Shojai

1 × 5,00 $

The Urban Monk with Pedram Shojai

1 × 5,00 $ -

×

Tantra Cure for Premature Ejaculation

1 × 5,00 $

Tantra Cure for Premature Ejaculation

1 × 5,00 $ -

×

RANK AND RENT with Tony Newton

1 × 5,00 $

RANK AND RENT with Tony Newton

1 × 5,00 $ -

×

Wealth Beyond Reason 2.0 with Bob Doyle

1 × 93,00 $

Wealth Beyond Reason 2.0 with Bob Doyle

1 × 93,00 $ -

×

Urotherapy: The Ancient Art of Self-Healing - Edward Group

1 × 69,00 $

Urotherapy: The Ancient Art of Self-Healing - Edward Group

1 × 69,00 $ -

×

Assessment & Electro-Acupuncture Treatment of Intrascapular Pain - Anthony Lombardi

1 × 39,00 $

Assessment & Electro-Acupuncture Treatment of Intrascapular Pain - Anthony Lombardi

1 × 39,00 $ -

×

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $ -

×

Power BI Financial Statements with Sebastian Taylor & Joseph Yeates - CFI Education

1 × 15,00 $

Power BI Financial Statements with Sebastian Taylor & Joseph Yeates - CFI Education

1 × 15,00 $ -

×

Google Analytics 4 for beginners - Fred Pike

1 × 39,00 $

Google Analytics 4 for beginners - Fred Pike

1 × 39,00 $ -

×

Internal Family Systems (IFS) and Attachment: Repairing the Internal Attachment By Frank Anderson - PESI

1 × 8,00 $

Internal Family Systems (IFS) and Attachment: Repairing the Internal Attachment By Frank Anderson - PESI

1 × 8,00 $ -

×

Sixty Years of Challenge - More Numbers, Less Flakes

1 × 5,00 $

Sixty Years of Challenge - More Numbers, Less Flakes

1 × 5,00 $ -

×

GearGods Presents Mastering Metal Mixing Prep & Setup with Eyal Levi

1 × 5,00 $

GearGods Presents Mastering Metal Mixing Prep & Setup with Eyal Levi

1 × 5,00 $ -

×

Underdog Profit System with Luther Landro

1 × 5,00 $

Underdog Profit System with Luther Landro

1 × 5,00 $ -

×

Future Riddim - Start To Finish with Dan Larsson

1 × 15,00 $

Future Riddim - Start To Finish with Dan Larsson

1 × 15,00 $ -

×

How I make $15K+ per week with Simple Software - Secret Marketer

1 × 5,00 $

How I make $15K+ per week with Simple Software - Secret Marketer

1 × 5,00 $ -

×

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $ -

×

Micro Content Mastery By The Real Deal Video Strategist Club

1 × 31,00 $

Micro Content Mastery By The Real Deal Video Strategist Club

1 × 31,00 $ -

×

Cement Studio 3D Model with PRO EDU

1 × 8,00 $

Cement Studio 3D Model with PRO EDU

1 × 8,00 $ -

×

Alkaline Awakening with Revival Of Wisdom

1 × 5,00 $

Alkaline Awakening with Revival Of Wisdom

1 × 5,00 $ -

×

Ultimate Family Karma Clearing (Package A+B) with Bonnie Serratore

1 × 31,00 $

Ultimate Family Karma Clearing (Package A+B) with Bonnie Serratore

1 × 31,00 $ -

×

Crimson Lotus with Arash Dibazar

1 × 5,00 $

Crimson Lotus with Arash Dibazar

1 × 5,00 $ -

×

EXSTORE Orthopedic System Online Training - Anthony Lombardi

1 × 389,00 $

EXSTORE Orthopedic System Online Training - Anthony Lombardi

1 × 389,00 $ -

×

Business by Design: Legacy By Unlock Your Design Academy

1 × 23,00 $

Business by Design: Legacy By Unlock Your Design Academy

1 × 23,00 $ -

×

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $ -

×

The Unchained Man: The Alpha Male 2.0 with Caleb Jones

1 × 5,00 $

The Unchained Man: The Alpha Male 2.0 with Caleb Jones

1 × 5,00 $ -

×

Niche Domination Prodigy

1 × 5,00 $

Niche Domination Prodigy

1 × 5,00 $ -

×

Persona AI Training with Mark Hess

1 × 5,00 $

Persona AI Training with Mark Hess

1 × 5,00 $ -

×

PSTEC with Tim Phizackerly

1 × 5,00 $

PSTEC with Tim Phizackerly

1 × 5,00 $ -

×

Beverage CGI Workflow in C4D & Photoshop with Dustin Valkema

1 × 8,00 $

Beverage CGI Workflow in C4D & Photoshop with Dustin Valkema

1 × 8,00 $ -

×

Easy AI Traffic Writer - The Google Free Traffic Sniper - Mark Hess

1 × 5,00 $

Easy AI Traffic Writer - The Google Free Traffic Sniper - Mark Hess

1 × 5,00 $ -

×

Watercolor Cards Made Simple with Deepti Malik

1 × 5,00 $

Watercolor Cards Made Simple with Deepti Malik

1 × 5,00 $ -

×

Business by Design: Protocol By Unlock Your Design Academy

1 × 23,00 $

Business by Design: Protocol By Unlock Your Design Academy

1 × 23,00 $ -

×

Olde English Abbey Composite Stock Assets 3 with Clinton Lofthouse

1 × 8,00 $

Olde English Abbey Composite Stock Assets 3 with Clinton Lofthouse

1 × 8,00 $ -

×

Dramatic Rocky Beach Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Dramatic Rocky Beach Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Automated Income Assets with Benjamin Fletcher

1 × 5,00 $

Automated Income Assets with Benjamin Fletcher

1 × 5,00 $ -

×

Double Your Freelancing Rate 2024 with Brennan Dunn

1 × 5,00 $

Double Your Freelancing Rate 2024 with Brennan Dunn

1 × 5,00 $ -

×

Local SEO DIY Boilerplate [Schema, Outreach Template, Local CItations & Profile Links] by Local SEO Guy

1 × 5,00 $

Local SEO DIY Boilerplate [Schema, Outreach Template, Local CItations & Profile Links] by Local SEO Guy

1 × 5,00 $ -

×

Hidden Burial Ground Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Hidden Burial Ground Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Start to Finish - Brutal Violent Dubstep with Dan Larsson

1 × 15,00 $

Start to Finish - Brutal Violent Dubstep with Dan Larsson

1 × 15,00 $ -

×

Hypnopower - Learn and Master Self-Hypnosis To Reach Your Goals - Alexander Fidelman

1 × 139,00 $

Hypnopower - Learn and Master Self-Hypnosis To Reach Your Goals - Alexander Fidelman

1 × 139,00 $ -

×

GearGods Presents: Mastering Metal Mixing: Fundamentals with Eyal Levi

1 × 5,00 $

GearGods Presents: Mastering Metal Mixing: Fundamentals with Eyal Levi

1 × 5,00 $ -

×

IFR Standards Workout 1 with Improvise for Real

1 × 8,00 $

IFR Standards Workout 1 with Improvise for Real

1 × 8,00 $ -

×

Affiliate Marketing On Crack with Benjamin Fletcher

1 × 5,00 $

Affiliate Marketing On Crack with Benjamin Fletcher

1 × 5,00 $ -

×

Funnel Hero GPT - EzProfitSoftware

1 × 5,00 $

Funnel Hero GPT - EzProfitSoftware

1 × 5,00 $ -

×

SHIFT by Julien Blanc

1 × 5,00 $

SHIFT by Julien Blanc

1 × 5,00 $ -

×

StyleLife - 31 Day Master Program: Online Academy for Attraction with Neil Strauss

1 × 5,00 $

StyleLife - 31 Day Master Program: Online Academy for Attraction with Neil Strauss

1 × 5,00 $ -

×

Film Booth – The Avatar Workshop 2023

1 × 5,00 $

Film Booth – The Avatar Workshop 2023

1 × 5,00 $ -

×

Build and Sell APIs – Establish a New Income Stream!

1 × 5,00 $

Build and Sell APIs – Establish a New Income Stream!

1 × 5,00 $ -

×

Chamber Music of Mozart with Robert Greenberg

1 × 5,00 $

Chamber Music of Mozart with Robert Greenberg

1 × 5,00 $ -

×

Elevate Your Singing and Stage Presence - Christina Aguilera

1 × 6,00 $

Elevate Your Singing and Stage Presence - Christina Aguilera

1 × 6,00 $ -

×

Parallette Training Level 1 and Level 2 - Gold Medal Bodies

1 × 5,00 $

Parallette Training Level 1 and Level 2 - Gold Medal Bodies

1 × 5,00 $ -

×

Soul Medicine with David Lion

1 × 319,00 $

Soul Medicine with David Lion

1 × 319,00 $ -

×

Shirt School Elite Package with Kerry Egeler

1 × 5,00 $

Shirt School Elite Package with Kerry Egeler

1 × 5,00 $ -

×

How To Chatgpt Plus, Prompt Engineering And Genai Course

1 × 5,00 $

How To Chatgpt Plus, Prompt Engineering And Genai Course

1 × 5,00 $ -

×

How to Create and Structure Content on LinkedIn with Hanna Larsson

1 × 5,00 $

How to Create and Structure Content on LinkedIn with Hanna Larsson

1 × 5,00 $ -

×

Olde English Abbey Composite Stock Assets 1 with Clinton Lofthouse

1 × 8,00 $

Olde English Abbey Composite Stock Assets 1 with Clinton Lofthouse

1 × 8,00 $ -

×

Policy Affects Practice & Students/Practitioners Affect Policy with Influencing Social Policy

1 × 8,00 $

Policy Affects Practice & Students/Practitioners Affect Policy with Influencing Social Policy

1 × 8,00 $ -

×

Bodybuilding Beyond the Basics - Alberto Nunez

1 × 5,00 $

Bodybuilding Beyond the Basics - Alberto Nunez

1 × 5,00 $ -

×

CRUX Blueprint – Get My Brand with Tony Shepherd

1 × 5,00 $

CRUX Blueprint – Get My Brand with Tony Shepherd

1 × 5,00 $ -

×

Memoir – True Story Software Add-On with John Truby

1 × 23,00 $

Memoir – True Story Software Add-On with John Truby

1 × 23,00 $ -

×

The Screenwriters Toolkit with Jim Uhls

1 × 5,00 $

The Screenwriters Toolkit with Jim Uhls

1 × 5,00 $ -

×

Digital Banking Fundamentals with Esteban Santana - CFI Education

1 × 15,00 $

Digital Banking Fundamentals with Esteban Santana - CFI Education

1 × 15,00 $ -

×

Knit Socks: Two at a Time! with Kate Atherley

1 × 5,00 $

Knit Socks: Two at a Time! with Kate Atherley

1 × 5,00 $ -

×

Old English Seaside Town Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Old English Seaside Town Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Assessment & Treatment of Lumbar Spinal Stenosis Using Electro-Acupuncture - Anthony Lombardi

1 × 46,00 $

Assessment & Treatment of Lumbar Spinal Stenosis Using Electro-Acupuncture - Anthony Lombardi

1 × 46,00 $ -

×

The Arrow Technique with Anthony Jacquin

1 × 5,00 $

The Arrow Technique with Anthony Jacquin

1 × 5,00 $ -

×

The Art Of Shaping Hard Light with Jason Buff

1 × 8,00 $

The Art Of Shaping Hard Light with Jason Buff

1 × 8,00 $ -

×

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $ -

×

Business by Design: Journey By Unlock Your Design Academy

1 × 23,00 $

Business by Design: Journey By Unlock Your Design Academy

1 × 23,00 $ -

×

xShot Email Method Course

1 × 5,00 $

xShot Email Method Course

1 × 5,00 $ -

×

Isle of Skye Rolling Seaside Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Isle of Skye Rolling Seaside Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Virtual Simple Studio 3D Model with PRO EDU

1 × 8,00 $

Virtual Simple Studio 3D Model with PRO EDU

1 × 8,00 $ -

×

Master Collection | Fine Art Portrait Textures with Kelly Robitaille

1 × 8,00 $

Master Collection | Fine Art Portrait Textures with Kelly Robitaille

1 × 8,00 $ -

×

Recycle Your Art with Andrea Chebeleu

1 × 5,00 $

Recycle Your Art with Andrea Chebeleu

1 × 5,00 $ -

×

Journey to the Center of Yourself Course 2023 with Josephine Hardman

1 × 78,00 $

Journey to the Center of Yourself Course 2023 with Josephine Hardman

1 × 78,00 $ -

×

Penis Enlargement & Virtual Viagra with Wendi Friesen

1 × 5,00 $

Penis Enlargement & Virtual Viagra with Wendi Friesen

1 × 5,00 $ -

×

Overcoming Procrastination - Self-Study Online Course By Ready2Go Marketing Solutions

1 × 23,00 $

Overcoming Procrastination - Self-Study Online Course By Ready2Go Marketing Solutions

1 × 23,00 $ -

×

Metaverse Empire with Alessandro Zamboni

1 × 5,00 $

Metaverse Empire with Alessandro Zamboni

1 × 5,00 $ -

×

Data Collection on the Web with Chris Mercer

1 × 39,00 $

Data Collection on the Web with Chris Mercer

1 × 39,00 $ -

×

AI Client Goldmine with Offline Sharks

1 × 5,00 $

AI Client Goldmine with Offline Sharks

1 × 5,00 $ -

×

Bill Davidson: Landscapes Reinvented: A New Method for Perfect Paintings

1 × 31,00 $

Bill Davidson: Landscapes Reinvented: A New Method for Perfect Paintings

1 × 31,00 $ -

×

Primal Seduction: Harness Primal Energy, Create Magnetic Attraction and Romance by Subliminal Club

1 × 15,00 $

Primal Seduction: Harness Primal Energy, Create Magnetic Attraction and Romance by Subliminal Club

1 × 15,00 $ -

×

Power Yoga for Weight Loss With Alex Esparza

1 × 6,00 $

Power Yoga for Weight Loss With Alex Esparza

1 × 6,00 $ -

×

Instruction of The Hypno Dom: A Master/slave Lifestyle Development Training on Erotic and Authoritarian Hypnosis with Joseph Crown

1 × 6,00 $

Instruction of The Hypno Dom: A Master/slave Lifestyle Development Training on Erotic and Authoritarian Hypnosis with Joseph Crown

1 × 6,00 $ -

×

SEO That Works 4.0 with Brian Dean

1 × 5,00 $

SEO That Works 4.0 with Brian Dean

1 × 5,00 $ -

×

FIRE FX with Cine Packs

1 × 15,00 $

FIRE FX with Cine Packs

1 × 15,00 $ -

×

Cash Flow Confidential with Jamie Sea

1 × 27,00 $

Cash Flow Confidential with Jamie Sea

1 × 27,00 $

Prime Services and Securities Lending with Andrew Loo – CFI Education

15,00 $

SKU: KEB. 45674JJpqh9Ga

Category: Finance

Tags: Andrew Loo, CFI Education, Prime Services and Securities Lending

Download Prime Services and Securities Lending with Andrew Loo – CFI Education, check content proof here:

Andrew Loo’s review of Prime Services and Securities Lending

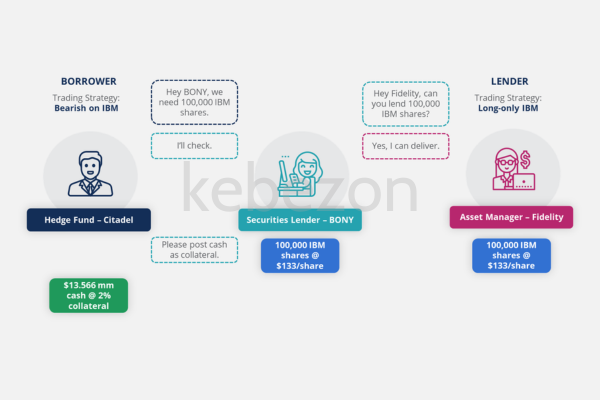

Anyone interested in navigating the capital markets must have a thorough grasp of the complexities of securities lending and prime services in an era where financial markets are always changing. An organized and perceptive summary of these crucial topics of finance is provided by Andrew Loo’s course at the Corporate Finance Institute (CFI). This self-paced course, which lasts around 1.5 hours, is appropriate for both beginners and seasoned professionals since it provides a combination of academic knowledge and practical insights. Because of Loo’s vast expertise in the financial industry, the material is enhanced and difficult ideas are easier for students to understand.

Opportunities abound in the prime services sector, especially for hedge funds. In addition to complex processes like securities lending that facilitate activities like short-selling, they depend on specialized services to prosper. Under the direction of Andrew Loo, students can explore the subtleties of how prime brokers entice investors and take on responsibilities such completing transaction clearing, managing margin needs, providing custodial services, and providing real-time reporting. Each of these components is essential to making sure hedge funds run smoothly and increase their potential for making money even in the face of financial market volatility.

Understanding Prime Services and Securities Lending

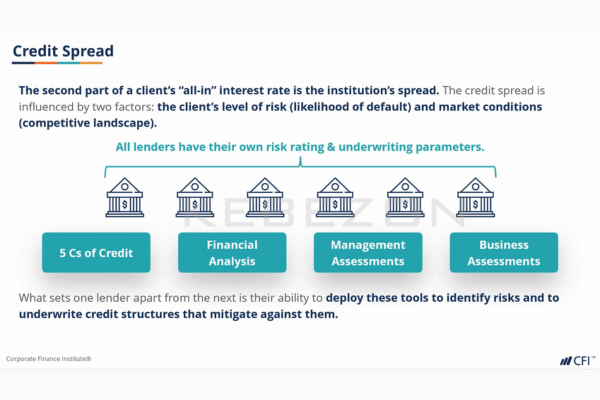

The Basics of Prime Services

Prime services are essentially the lifeline for hedge funds. Just as a ship needs a steady compass to navigate through turbulent waters, hedge funds require prime brokers to guide them through the complexities of capital markets. These brokers provide a range of essential services, including:

- Margin Requirement Management: Ensuring that hedge funds have the necessary capital to leverage their positions effectively.

- Trade Clearing: Facilitating the smooth execution and settlement of trades, minimizing the risk of errors and delays.

- Custodial Services: Safeguarding assets and managing the administrative tasks related to fund management.

- Real-Time Reporting: Offering insight into performance metrics and risk exposure, thus enabling informed decision-making.

As Andrew Loo emphasizes in his course, understanding these components can significantly enhance a financial professional’s ability to contribute effectively within the hedge fund ecosystem.

Securities Lending’s Function

A key component of prime services is securities financing, especially in relation to short-selling. Imagine it as a link between lenders and borrowers, allowing one of them to use securities as leverage to take advantage of changes in the market. Here are important things to think about:

- Dynamics of the Market: Lending for securities is essential for improving market efficiency and liquidity. Short-sellers can exert pressure on overpriced companies and bring market prices closer to their intrinsic values by being granted the ability to borrow shares.

- Short-Selling Mechanics: Any financial expert must comprehend short interest and interest ratios. Traders can examine data that reveal market mood and spot possible opportunities by using systems such as Refinitiv Workspace.

- Effect on Institutional Investors: There is a significant interaction between institutional investors and securities lending. Organizations that make stock loans can

Short Sellers and Stock Lenders

Each actor in the securities lending market plays a specific role, essentially shaping the overall landscape of capital markets. Analyzing these roles helps illuminate the flow of capital and the risks involved:

- Short Sellers: Typically hedge funds or traders aiming to profit from declining stock prices. Their actions can lead to increased volatility but also contribute to price correction.

- Stock Lenders: Often institutional investors, they possess a robust portfolio that can be lent out. In return, they earn fees from borrowers, creating a continuous cycle of revenue generation.

By understanding the mechanics of how these entities interact within the securities lending framework, learners can appreciate the overarching significance of their roles in the financial ecosystem.

The Knowledge and Experience of Andrew Loo’s Many Years

In addition to the course material, Andrew Loo’s experience in the financial services industry makes him unique. With more than 20 years of experience, including a successful stint as Managing Director at Nomura Securities in Hong Kong, Loo provides priceless real-world knowledge to enhance academic instruction. He has gained extensive understanding of investor behavior, risk management, and market dynamics by overseeing relationships with important institutional investors.

His professional expertise guarantees that students are interacting with things that have real-world relevance in the current financial environment rather than just learning theoretical notions. Because of this link, the course becomes a springboard for future financial jobs rather than just an educational experience.

Reviews and Student Experiences

Feedback from students who have taken Loo’s course indicates a positive reception. Common themes in reviews include:

- Informative Content: Students express that the material is relevant and covers crucial aspects of prime services and securities lending comprehensively.

- Clear Explanation: Many note Loo’s talent for breaking down complex concepts, making them accessible to individuals without extensive backgrounds in finance.

- Practical Foundation: Reviewers emphasize that the course serves as an excellent foundation for those interested in pursuing careers in hedge funds, capital markets management, or securities lending.

These testimonials indicate that Loo’s course meets its goal of equiping learners with the necessary skills and knowledge to navigate a challenging financial landscape.

Relevance to the Market and Industry Use for Professionals

Prime services and securities lending are not only specialized subjects in a financial climate that is changing quickly; they are essential to effective market operations. Professionals that are knowledgeable about these topics can position themselves strategically within the sector and open up new career paths.

For example, traders may make wise investment choices by comprehending short interest and interest ratios, which are covered in Loo’s course. Whether investors are starting long positions in cheap stocks or short-selling to protect themselves from future market drops, they may use this information to create wise tactics.

Prospects for Prime Services and Securities Lending in the Future

The fields of securities lending and prime services are set to undergo significant change in the future. The way these services are provided will probably change as a result of emerging technology, shifting regulations, and shifting market dynamics. Important trends to watch are as follows:

- Technological Innovation: Advancements in financial technology could streamline operations, enhancing efficiency in managing trades and reporting.

- Regulatory Changes: As governments and financial authorities adapt to market challenges, new regulations could redefine the landscape of securities lending.

- Sustainable Investing: The growing emphasis on ESG (Environmental, Social, Governance) criteria could necessitate alterations in how securities lending is approached and executed.

In conclusion

Finally, for ambitious finance professionals eager to understand the intricacies of capital markets, Andrew Loo’s “Prime Services and Securities Lending” course at the Corporate Finance Institute is a shining example. Together with Loo’s wealth of knowledge, the methodical approach offers a comprehensive educational experience that gives students the tools they need to succeed.

Positive evaluations and testimonies for the course demonstrate how much Andrew Loo’s lectures and insights influence students. Those that are knowledgeable about securities lending and prime services will surely be in a better position to adjust and prosper as the financial sector continues to embrace change.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Prime Services and Securities Lending with Andrew Loo – CFI Education” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.