-

×

A Biopsychosocial Approach to Clinical Practice with The Knowledge Exchange

1 × 148,00 $

A Biopsychosocial Approach to Clinical Practice with The Knowledge Exchange

1 × 148,00 $ -

×

Extreme Social Proof Aphrodisiac 5.11G (Type A/B/C/D Hybrid) with Subliminal Shop

1 × 93,00 $

Extreme Social Proof Aphrodisiac 5.11G (Type A/B/C/D Hybrid) with Subliminal Shop

1 × 93,00 $ -

×

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $ -

×

ATTRACTION MASTERY Course with Mystery and Beckster

1 × 194,00 $

ATTRACTION MASTERY Course with Mystery and Beckster

1 × 194,00 $ -

×

Affiliate Marketing On Crack with Benjamin Fletcher

1 × 5,00 $

Affiliate Marketing On Crack with Benjamin Fletcher

1 × 5,00 $ -

×

Referral Program with Kelli Marie Connor

1 × 5,00 $

Referral Program with Kelli Marie Connor

1 × 5,00 $ -

×

The Winds Of Change with Arash Dibazar

1 × 5,00 $

The Winds Of Change with Arash Dibazar

1 × 5,00 $ -

×

How to Remember Your Dreams with Anthony Metivier - Magnetic Memory Method

1 × 5,00 $

How to Remember Your Dreams with Anthony Metivier - Magnetic Memory Method

1 × 5,00 $ -

×

Bodybuilding Beyond the Basics - Alberto Nunez

1 × 5,00 $

Bodybuilding Beyond the Basics - Alberto Nunez

1 × 5,00 $ -

×

Deep Dive Calendars & Diagonals Class with SJG Trades

1 × 39,00 $

Deep Dive Calendars & Diagonals Class with SJG Trades

1 × 39,00 $ -

×

Mystery's Bundle - Hey Guys! Audiobook + eBooks Hey Guys! and Book of Negs by Ask Mystery

1 × 15,00 $

Mystery's Bundle - Hey Guys! Audiobook + eBooks Hey Guys! and Book of Negs by Ask Mystery

1 × 15,00 $ -

×

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $ -

×

Creating Seamless Textures in Photoshop with Stone River eLearning

1 × 6,00 $

Creating Seamless Textures in Photoshop with Stone River eLearning

1 × 6,00 $ -

×

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $ -

×

SSL Sniper with Tom Gaddis and Nick Ponte

1 × 5,00 $

SSL Sniper with Tom Gaddis and Nick Ponte

1 × 5,00 $ -

×

Editorial Wedding Photography with Jasmine Star

1 × 6,00 $

Editorial Wedding Photography with Jasmine Star

1 × 6,00 $ -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × 20,00 $

The Situational Order Flow Trading Course with Mike Valtos

1 × 20,00 $ -

×

Of Rocks and Flowers: Dealing with the Abuse of Children with Virginia Satir

1 × 8,00 $

Of Rocks and Flowers: Dealing with the Abuse of Children with Virginia Satir

1 × 8,00 $ -

×

Niche Domination Prodigy

1 × 5,00 $

Niche Domination Prodigy

1 × 5,00 $ -

×

P90X with Tony Horton

1 × 5,00 $

P90X with Tony Horton

1 × 5,00 $ -

×

Read The Market RTM Master Trader Course + Journals

1 × 5,00 $

Read The Market RTM Master Trader Course + Journals

1 × 5,00 $ -

×

High Status Seduction with PUA Training

1 × 5,00 $

High Status Seduction with PUA Training

1 × 5,00 $ -

×

Renzo Gracie - Special Class with Renzo Gracie

1 × 6,00 $

Renzo Gracie - Special Class with Renzo Gracie

1 × 6,00 $

Prime Services and Securities Lending with Andrew Loo – CFI Education

15,00 $

SKU: KEB. 45674JJpqh9Ga

Category: Finance

Tags: Andrew Loo, CFI Education, Prime Services and Securities Lending

Download Prime Services and Securities Lending with Andrew Loo – CFI Education, check content proof here:

Andrew Loo’s review of Prime Services and Securities Lending

Anyone interested in navigating the capital markets must have a thorough grasp of the complexities of securities lending and prime services in an era where financial markets are always changing. An organized and perceptive summary of these crucial topics of finance is provided by Andrew Loo’s course at the Corporate Finance Institute (CFI). This self-paced course, which lasts around 1.5 hours, is appropriate for both beginners and seasoned professionals since it provides a combination of academic knowledge and practical insights. Because of Loo’s vast expertise in the financial industry, the material is enhanced and difficult ideas are easier for students to understand.

Opportunities abound in the prime services sector, especially for hedge funds. In addition to complex processes like securities lending that facilitate activities like short-selling, they depend on specialized services to prosper. Under the direction of Andrew Loo, students can explore the subtleties of how prime brokers entice investors and take on responsibilities such completing transaction clearing, managing margin needs, providing custodial services, and providing real-time reporting. Each of these components is essential to making sure hedge funds run smoothly and increase their potential for making money even in the face of financial market volatility.

Understanding Prime Services and Securities Lending

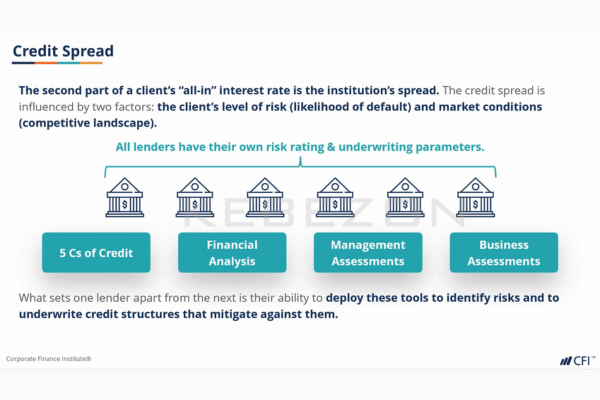

The Basics of Prime Services

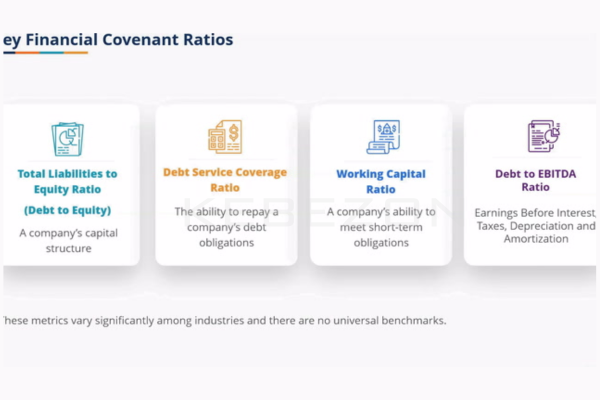

Prime services are essentially the lifeline for hedge funds. Just as a ship needs a steady compass to navigate through turbulent waters, hedge funds require prime brokers to guide them through the complexities of capital markets. These brokers provide a range of essential services, including:

- Margin Requirement Management: Ensuring that hedge funds have the necessary capital to leverage their positions effectively.

- Trade Clearing: Facilitating the smooth execution and settlement of trades, minimizing the risk of errors and delays.

- Custodial Services: Safeguarding assets and managing the administrative tasks related to fund management.

- Real-Time Reporting: Offering insight into performance metrics and risk exposure, thus enabling informed decision-making.

As Andrew Loo emphasizes in his course, understanding these components can significantly enhance a financial professional’s ability to contribute effectively within the hedge fund ecosystem.

Securities Lending’s Function

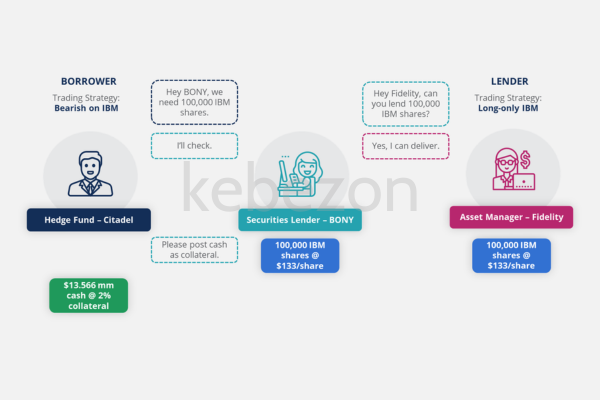

A key component of prime services is securities financing, especially in relation to short-selling. Imagine it as a link between lenders and borrowers, allowing one of them to use securities as leverage to take advantage of changes in the market. Here are important things to think about:

- Dynamics of the Market: Lending for securities is essential for improving market efficiency and liquidity. Short-sellers can exert pressure on overpriced companies and bring market prices closer to their intrinsic values by being granted the ability to borrow shares.

- Short-Selling Mechanics: Any financial expert must comprehend short interest and interest ratios. Traders can examine data that reveal market mood and spot possible opportunities by using systems such as Refinitiv Workspace.

- Effect on Institutional Investors: There is a significant interaction between institutional investors and securities lending. Organizations that make stock loans can

Short Sellers and Stock Lenders

Each actor in the securities lending market plays a specific role, essentially shaping the overall landscape of capital markets. Analyzing these roles helps illuminate the flow of capital and the risks involved:

- Short Sellers: Typically hedge funds or traders aiming to profit from declining stock prices. Their actions can lead to increased volatility but also contribute to price correction.

- Stock Lenders: Often institutional investors, they possess a robust portfolio that can be lent out. In return, they earn fees from borrowers, creating a continuous cycle of revenue generation.

By understanding the mechanics of how these entities interact within the securities lending framework, learners can appreciate the overarching significance of their roles in the financial ecosystem.

The Knowledge and Experience of Andrew Loo’s Many Years

In addition to the course material, Andrew Loo’s experience in the financial services industry makes him unique. With more than 20 years of experience, including a successful stint as Managing Director at Nomura Securities in Hong Kong, Loo provides priceless real-world knowledge to enhance academic instruction. He has gained extensive understanding of investor behavior, risk management, and market dynamics by overseeing relationships with important institutional investors.

His professional expertise guarantees that students are interacting with things that have real-world relevance in the current financial environment rather than just learning theoretical notions. Because of this link, the course becomes a springboard for future financial jobs rather than just an educational experience.

Reviews and Student Experiences

Feedback from students who have taken Loo’s course indicates a positive reception. Common themes in reviews include:

- Informative Content: Students express that the material is relevant and covers crucial aspects of prime services and securities lending comprehensively.

- Clear Explanation: Many note Loo’s talent for breaking down complex concepts, making them accessible to individuals without extensive backgrounds in finance.

- Practical Foundation: Reviewers emphasize that the course serves as an excellent foundation for those interested in pursuing careers in hedge funds, capital markets management, or securities lending.

These testimonials indicate that Loo’s course meets its goal of equiping learners with the necessary skills and knowledge to navigate a challenging financial landscape.

Relevance to the Market and Industry Use for Professionals

Prime services and securities lending are not only specialized subjects in a financial climate that is changing quickly; they are essential to effective market operations. Professionals that are knowledgeable about these topics can position themselves strategically within the sector and open up new career paths.

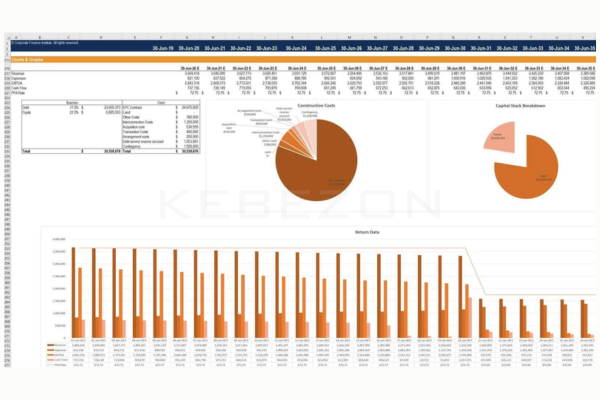

For example, traders may make wise investment choices by comprehending short interest and interest ratios, which are covered in Loo’s course. Whether investors are starting long positions in cheap stocks or short-selling to protect themselves from future market drops, they may use this information to create wise tactics.

Prospects for Prime Services and Securities Lending in the Future

The fields of securities lending and prime services are set to undergo significant change in the future. The way these services are provided will probably change as a result of emerging technology, shifting regulations, and shifting market dynamics. Important trends to watch are as follows:

- Technological Innovation: Advancements in financial technology could streamline operations, enhancing efficiency in managing trades and reporting.

- Regulatory Changes: As governments and financial authorities adapt to market challenges, new regulations could redefine the landscape of securities lending.

- Sustainable Investing: The growing emphasis on ESG (Environmental, Social, Governance) criteria could necessitate alterations in how securities lending is approached and executed.

In conclusion

Finally, for ambitious finance professionals eager to understand the intricacies of capital markets, Andrew Loo’s “Prime Services and Securities Lending” course at the Corporate Finance Institute is a shining example. Together with Loo’s wealth of knowledge, the methodical approach offers a comprehensive educational experience that gives students the tools they need to succeed.

Positive evaluations and testimonies for the course demonstrate how much Andrew Loo’s lectures and insights influence students. Those that are knowledgeable about securities lending and prime services will surely be in a better position to adjust and prosper as the financial sector continues to embrace change.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Prime Services and Securities Lending with Andrew Loo – CFI Education” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.