-

×

Passionate Marriage Keeping Love and Intimacy Alive in Committed Relationships with David Schnarch

1 × 5,00 $

Passionate Marriage Keeping Love and Intimacy Alive in Committed Relationships with David Schnarch

1 × 5,00 $ -

×

Learning to Light Day Interiors with Shane Hurlbut

1 × 8,00 $

Learning to Light Day Interiors with Shane Hurlbut

1 × 8,00 $ -

×

Advanced Overage Bootcamp - All Things Overages

1 × 209,00 $

Advanced Overage Bootcamp - All Things Overages

1 × 209,00 $ -

×

Central Bank Trading Strategies - AXIA Futures

1 × 5,00 $

Central Bank Trading Strategies - AXIA Futures

1 × 5,00 $ -

×

AI Client Goldmine with Offline Sharks

1 × 5,00 $

AI Client Goldmine with Offline Sharks

1 × 5,00 $ -

×

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $ -

×

Affiliate Millions

1 × 5,00 $

Affiliate Millions

1 × 5,00 $ -

×

Courageous Coaching Certification with Kendall SummerHawk

1 × 54,00 $

Courageous Coaching Certification with Kendall SummerHawk

1 × 54,00 $ -

×

How To Get Your Clients To Send You More Clients with Maria Wendt

1 × 5,00 $

How To Get Your Clients To Send You More Clients with Maria Wendt

1 × 5,00 $ -

×

The Handsome Factor Guidance For Every Alpha Male with Mark Belmont

1 × 5,00 $

The Handsome Factor Guidance For Every Alpha Male with Mark Belmont

1 × 5,00 $ -

×

AI Disruptor 2.0 - James Renouf and Dave Espino

1 × 5,00 $

AI Disruptor 2.0 - James Renouf and Dave Espino

1 × 5,00 $ -

×

Ancestral Healing Course with Teal Swan

1 × 28,00 $

Ancestral Healing Course with Teal Swan

1 × 28,00 $ -

×

Data Collection on the Web with Chris Mercer

1 × 39,00 $

Data Collection on the Web with Chris Mercer

1 × 39,00 $ -

×

StyleLife - 31 Day Master Program: Online Academy for Attraction with Neil Strauss

1 × 5,00 $

StyleLife - 31 Day Master Program: Online Academy for Attraction with Neil Strauss

1 × 5,00 $ -

×

Reclaiming Ancient Dreamways with Robert Moss - The Shift Network

1 × 93,00 $

Reclaiming Ancient Dreamways with Robert Moss - The Shift Network

1 × 93,00 $ -

×

The Art Of Shaping Colored Light with Jason Buff

1 × 8,00 $

The Art Of Shaping Colored Light with Jason Buff

1 × 8,00 $ -

×

New Workout Program with Caliathletics

1 × 5,00 $

New Workout Program with Caliathletics

1 × 5,00 $ -

×

Half Guard: sweeps and submissions with André Monteiro

1 × 6,00 $

Half Guard: sweeps and submissions with André Monteiro

1 × 6,00 $ -

×

MageAI Unlimited with Satish Gaire

1 × 5,00 $

MageAI Unlimited with Satish Gaire

1 × 5,00 $ -

×

The Vedic Secrets of the Nakshatras with Vamadeva Shastri

1 × 39,00 $

The Vedic Secrets of the Nakshatras with Vamadeva Shastri

1 × 39,00 $ -

×

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $ -

×

DreamerGG – Mentorship 2023

1 × 5,00 $

DreamerGG – Mentorship 2023

1 × 5,00 $ -

×

Business by Design: Strategy & Authority By Unlock Your Design Academy

1 × 23,00 $

Business by Design: Strategy & Authority By Unlock Your Design Academy

1 × 23,00 $ -

×

Double Your Freelancing Rate 2024 with Brennan Dunn

1 × 5,00 $

Double Your Freelancing Rate 2024 with Brennan Dunn

1 × 5,00 $ -

×

Expand Your Innate Mediumship Skills With Soul-to-Soul Communication - Suzanne Giesemann - The Shift Network

1 × 54,00 $

Expand Your Innate Mediumship Skills With Soul-to-Soul Communication - Suzanne Giesemann - The Shift Network

1 × 54,00 $ -

×

How To Set Up Your Own SEO Agency From Home - 100% Fully Automated Business System - Uper Agency

1 × 5,00 $

How To Set Up Your Own SEO Agency From Home - 100% Fully Automated Business System - Uper Agency

1 × 5,00 $ -

×

Masculine Edge with Dr. Farhan Khawaja

1 × 5,00 $

Masculine Edge with Dr. Farhan Khawaja

1 × 5,00 $ -

×

Penis Enlargement & Virtual Viagra with Wendi Friesen

1 × 5,00 $

Penis Enlargement & Virtual Viagra with Wendi Friesen

1 × 5,00 $ -

×

Edit with Trev and Master CapCut - Trevor Jones

1 × 5,00 $

Edit with Trev and Master CapCut - Trevor Jones

1 × 5,00 $ -

×

Smarter Not Harder with Dave Asprey

1 × 5,00 $

Smarter Not Harder with Dave Asprey

1 × 5,00 $ -

×

Persona AI Training with Mark Hess

1 × 5,00 $

Persona AI Training with Mark Hess

1 × 5,00 $ -

×

LIIFT MORE Super Block by Joel Freeman

1 × 5,00 $

LIIFT MORE Super Block by Joel Freeman

1 × 5,00 $ -

×

How To Chatgpt Plus, Prompt Engineering And Genai Course

1 × 5,00 $

How To Chatgpt Plus, Prompt Engineering And Genai Course

1 × 5,00 $ -

×

Relational EMDR Experiential Course with Deany Laliotis: Step-by-Step Skills and Consultation - Deany Laliotis - PESI

1 × 62,00 $

Relational EMDR Experiential Course with Deany Laliotis: Step-by-Step Skills and Consultation - Deany Laliotis - PESI

1 × 62,00 $ -

×

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $

Repo (Repurchase Agreements) By Meeyeon Park – CFI Education

15,00 $

SKU: KEB. 44820mzVc37bD

Category: Finance

Tags: CFI Education, Meeyeon Park, Repo, Repurchase Agreements

You may check content proof of “Repo (Repurchase Agreements) By Meeyeon Park – CFI Education” below:

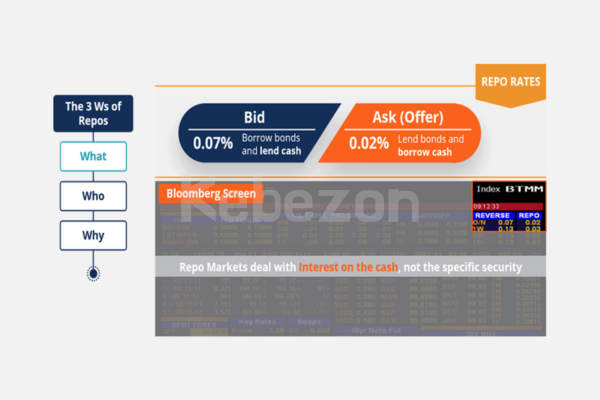

Understanding Repurchase Agreements: Insights from Meeyeon Park

In the complex world of borrowing and lending inside financial markets, repurchase agreements, or repos, are an essential financial tool. These agreements provide a systematic approach to managing short-term funding needs while guaranteeing transaction security, as explained by Meeyeon Park, Vice President of Private Wealth Management at the Corporate Finance Institute (CFI). Through the prism of Meeyeon Park’s vast experience, this paper explores the fundamentals of repos, the dangers they include, and their importance in preserving liquidity in financial markets.

The Mechanics of Repurchase Agreements

What is a Repurchase Agreement?

Under buyback agreements, one party sells securities to another with the understanding that the same securities would be bought back later at a fixed price. This arrangement is a result of the demand for both security and liquidity. The securities are essentially turned into a short-term loan by the seller using them as collateral. Consider a repo, for example, as a cordial handshake *** between two people; one loans money, and the other provides securities as collateral and a means of confidence.

This arrangement is crucial to the overall state of the economy and goes beyond simple financial flow. The repo market really acts as the foundation for a number of financial operations, enabling organizations to effectively manage their asset portfolios without having to sell up precious assets. Park emphasizes that these transactions are particularly useful during periods of market volatility, providing financial institutions the liquidity needed to navigate uncertainties.

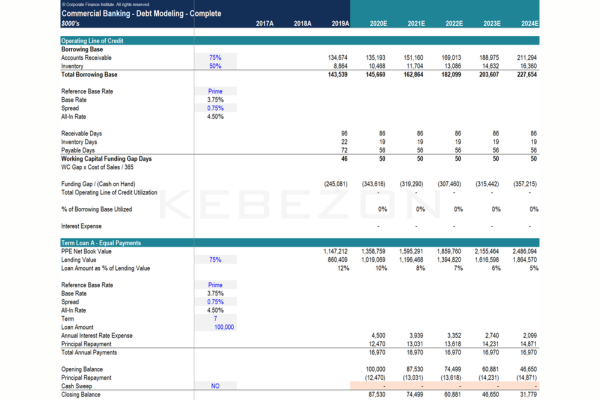

The Scale of Repo Utilization

Repos are ubiquitous in the financial world, with estimates suggesting that financial firms engage in borrowing approximately $4 trillion through repos. This substantial figure underscores the reliance of financial institutions on repos as a financing mechanism. To illustrate the scale further, consider the following table that outlines various aspects of repo transactions:

| Aspect | Details |

| Market Size | Approximately $4 trillion in borrowed funds |

| Key Participants | Banks, hedge funds, insurance companies, and other financial entities |

| Collateral Types | Government bonds, corporate bonds, and other securities |

| Duration | Typically overnight to a few weeks |

This table succinctly captures the fundamental nature of repo transactions, illustrating not only their prevalence but also the diversity of participants involved.

The Importance of Repos in Liquidity Management

How Repos Facilitate Liquidity

A key component of today’s fast-paced financial industry is efficient liquidity management. Without having to sell their assets completely, financial institutions may swiftly turn their securities into cash through repos. For a number of functions, including as financing trading positions, managing unplanned costs, and satisfying regulatory requirements, this liquidity is essential.

According to Park, repos are a well-designed financial lifeline that may give institutions the rapid cash infusions they sorely need to continue operating when markets are volatile or crises are imminent. Financial systems may experience significant disruptions in the absence of this mechanism, which might result in wider market volatility.

Repo Markets during Crises

Historically, during financial crises, the repo market has proven to be a lifeline. For example, during the 2008 financial crisis, repos helped institutions navigate liquidity challenges, allowing them to stabilize their operations while managing the fallout from asset devaluation. The repo market serves as both a barometer and a bulwark against economic turbulence, highlighting its critical role in financial resilience.

Risks Associated with Repurchase Agreements

Understanding the Inherent Risks

Even though repos have several basic advantages, Meeyeon Park is not afraid to discuss the hazards involved with these financial products. It’s critical to understand that, despite their potential to offer liquidity, repos have certain inherent risks. The following are the main dangers involved:

- Default risk is the possibility that the buyer may suffer losses if the seller does not buy back the securities.

- Collateral Risk: Situations where the collateral is insufficient to support the amount borrowed may arise due to shifts in the collateral’s market value.

- Legal Risk: If the agreements’ provisions are unclear or poorly understood, problems might occur and litigation could result.

The Impact of Market Conditions

Because financial markets are dynamic, the security and stability of repos might change depending on the situation. When the collateral’s value drops, margin calls may be initiated, forcing the borrowing party to submit more collateral or risk liquidation. Both parties may be impacted by this vulnerability, which might have a domino effect and jeopardize financial stability.

To comprehend these risks ***ter, consider the following list outlining the potential hazards involved in repos:

- Default Risk: The risk of the counterparty failing to fulfill obligations.

- Collateral Valuation Risk: Fluctuating prices of collateral leading to insufficient coverage of borrowed amounts.

- Liquidity Risk: Potential difficulty in quickly selling the collateral in a stressed market.

- Legal Compliance Risk: Issues arising from non-compliance with regulatory requirements.

Addressing these risks requires vigilance, robust risk management strategies, and comprehensive legal frameworks to protect all parties involved.

Conclusion: The Dual Nature of Repurchase Agreements

In conclusion, Meeyeon Park provides deep understanding of the function of repos in financial markets, exposing their intricacy and inherent dangers. Although repurchase agreements are a crucial financial mechanism that improves liquidity and operational effectiveness, they also carry a number of serious risks that should be carefully considered and managed. The contrast between these benefits and weaknesses draws attention to the fine balance that financial institutions need to keep.

The significance of repos will only grow as we traverse a more linked global financial environment. Our knowledge of these complex instruments may be expanded by using materials from professionals like Meeyeon Park, which will better prepare us to handle the possibilities and difficulties that lie ahead. Examining the courses and resources offered by the Corporate Finance Institute is a wise next step for anybody looking to improve their financial literacy.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Repo (Repurchase Agreements) By Meeyeon Park – CFI Education” Cancel reply

You must be logged in to post a review.

Related products

Finance

Finance

Reviews

There are no reviews yet.