-

×

English Landscape Malham Cove Gordal Scar & Janets Foss Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

English Landscape Malham Cove Gordal Scar & Janets Foss Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

JOYRYDE Style Bass House Start To Finish with Dan Larsson

1 × 15,00 $

JOYRYDE Style Bass House Start To Finish with Dan Larsson

1 × 15,00 $ -

×

The Power of Decision with Raymond Charles Barker

1 × 5,00 $

The Power of Decision with Raymond Charles Barker

1 × 5,00 $ -

×

eBay Cash Magnet - Unlocking Wealth with Virtual Goods & Zero Inventory - Jafar Najafov

1 × 5,00 $

eBay Cash Magnet - Unlocking Wealth with Virtual Goods & Zero Inventory - Jafar Najafov

1 × 5,00 $ -

×

Elite POD Course + Playbook with Jesse Anselm

1 × 26,00 $

Elite POD Course + Playbook with Jesse Anselm

1 × 26,00 $ -

×

AI Branding Beast with Mark Hess

1 × 5,00 $

AI Branding Beast with Mark Hess

1 × 5,00 $ -

×

Persona AI Training with Mark Hess

1 × 5,00 $

Persona AI Training with Mark Hess

1 × 5,00 $ -

×

The Urban Monk with Pedram Shojai

1 × 5,00 $

The Urban Monk with Pedram Shojai

1 × 5,00 $ -

×

Rainmaker Novation 3.0 - Richard Wonders

1 × 31,00 $

Rainmaker Novation 3.0 - Richard Wonders

1 × 31,00 $ -

×

Being Confident Is Accepting The Good And The Bad with Cory Skyy

1 × 5,00 $

Being Confident Is Accepting The Good And The Bad with Cory Skyy

1 × 5,00 $ -

×

English Landscape Nidderdale Composite Stock Assets 1 with Clinton Lofthouse

1 × 8,00 $

English Landscape Nidderdale Composite Stock Assets 1 with Clinton Lofthouse

1 × 8,00 $ -

×

Credit Administration and Documentation with Scott Powell - CFI Education

1 × 15,00 $

Credit Administration and Documentation with Scott Powell - CFI Education

1 × 15,00 $ -

×

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $

Mini MBA in Brand Management with Mark Ritson

1 × 31,00 $ -

×

Auto-Affiliate AI - Live Demo: Watch This ChatGPT App Passively

1 × 5,00 $

Auto-Affiliate AI - Live Demo: Watch This ChatGPT App Passively

1 × 5,00 $ -

×

The Envisioning Method with Vishen Lakhiani

1 × 5,00 $

The Envisioning Method with Vishen Lakhiani

1 × 5,00 $ -

×

Selling on Amazon: Perfecting Traffic and Conversions - Mina Elias

1 × 39,00 $

Selling on Amazon: Perfecting Traffic and Conversions - Mina Elias

1 × 39,00 $ -

×

Crimson Lotus with Arash Dibazar

1 × 5,00 $

Crimson Lotus with Arash Dibazar

1 × 5,00 $ -

×

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $

Startup / e-Commerce Financial Model & Valuation with Tim Vipond - CFI Education

1 × 15,00 $ -

×

Marketing Mastery to RaiseUp Your Business by Kami Guildner

1 × 93,00 $

Marketing Mastery to RaiseUp Your Business by Kami Guildner

1 × 93,00 $ -

×

Customer Segmentation for Ecommerce - George Kapernaros

1 × 39,00 $

Customer Segmentation for Ecommerce - George Kapernaros

1 × 39,00 $ -

×

Bodybuilding Beyond the Basics - Alberto Nunez

1 × 5,00 $

Bodybuilding Beyond the Basics - Alberto Nunez

1 × 5,00 $ -

×

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $

Adyashanti - The Art of Meditation Video Study Course

1 × 5,00 $ -

×

Steps to Everyday Productivity - April and Eric Perry

1 × 22,00 $

Steps to Everyday Productivity - April and Eric Perry

1 × 22,00 $ -

×

Pro Photo Editing Course by Maarten Schrader

1 × 46,00 $

Pro Photo Editing Course by Maarten Schrader

1 × 46,00 $ -

×

Joy of Massage With Tessa Canzona

1 × 6,00 $

Joy of Massage With Tessa Canzona

1 × 6,00 $ -

×

AgencyLab.io – Agency Accelerator with Joel Kaplan

1 × 5,00 $

AgencyLab.io – Agency Accelerator with Joel Kaplan

1 × 5,00 $ -

×

Traffic Stream with Fergal Downes

1 × 5,00 $

Traffic Stream with Fergal Downes

1 × 5,00 $ -

×

True Authentic Reality Experience - Beast Mode

1 × 5,00 $

True Authentic Reality Experience - Beast Mode

1 × 5,00 $ -

×

Interview Series with Love Systems

1 × 5,00 $

Interview Series with Love Systems

1 × 5,00 $ -

×

Business by Design: Protocol By Unlock Your Design Academy

1 × 23,00 $

Business by Design: Protocol By Unlock Your Design Academy

1 × 23,00 $ -

×

Method Self-Study by Yes Supply

1 × 23,00 $

Method Self-Study by Yes Supply

1 × 23,00 $ -

×

GearGods Presents: Mastering Metal Mixing: Finalizing Your Mix with Eyal Levi

1 × 5,00 $

GearGods Presents: Mastering Metal Mixing: Finalizing Your Mix with Eyal Levi

1 × 5,00 $ -

×

Systems Health Care Next Level - Series 4 By Stephen Gangemi - Systems Health Care

1 × 93,00 $

Systems Health Care Next Level - Series 4 By Stephen Gangemi - Systems Health Care

1 × 93,00 $ -

×

Four Steps to Encreasing Intuition with Court of Atonement

1 × 8,00 $

Four Steps to Encreasing Intuition with Court of Atonement

1 × 8,00 $ -

×

xShot Email Method Course

1 × 5,00 $

xShot Email Method Course

1 × 5,00 $ -

×

Extreme Social Proof Aphrodisiac 5.11G (Type A/B/C/D Hybrid) with Subliminal Shop

1 × 93,00 $

Extreme Social Proof Aphrodisiac 5.11G (Type A/B/C/D Hybrid) with Subliminal Shop

1 × 93,00 $ -

×

Memoir – True Story Software Add-On with John Truby

1 × 23,00 $

Memoir – True Story Software Add-On with John Truby

1 × 23,00 $ -

×

Inboxlab.io Program by Jimmy Fung

1 × 5,00 $

Inboxlab.io Program by Jimmy Fung

1 × 5,00 $ -

×

The 12-Week Rapid Transformation Intensive by Benjamin Hardy

1 × 25,00 $

The 12-Week Rapid Transformation Intensive by Benjamin Hardy

1 × 25,00 $ -

×

Amazing Selling Machine 14+Bonuses UP2 - Matt Clark

1 × 5,00 $

Amazing Selling Machine 14+Bonuses UP2 - Matt Clark

1 × 5,00 $ -

×

The Power Of Instagram By Club Life Design

1 × 5,00 $

The Power Of Instagram By Club Life Design

1 × 5,00 $ -

×

Burn the Fat, Feed the Muscle Transform Your Body Forever Using the Secrets of the Leanest People in the World - Tom Venuto

1 × 5,00 $

Burn the Fat, Feed the Muscle Transform Your Body Forever Using the Secrets of the Leanest People in the World - Tom Venuto

1 × 5,00 $ -

×

AX 1 with Jeff Cavaliere - AthleanX

1 × 5,00 $

AX 1 with Jeff Cavaliere - AthleanX

1 × 5,00 $ -

×

10 Part Business Start with Michael Sasser

1 × 23,00 $

10 Part Business Start with Michael Sasser

1 × 23,00 $ -

×

Reclaiming Ancient Dreamways with Robert Moss - The Shift Network

1 × 93,00 $

Reclaiming Ancient Dreamways with Robert Moss - The Shift Network

1 × 93,00 $ -

×

The CEO Club with Jamie Sea

1 × 29,00 $

The CEO Club with Jamie Sea

1 × 29,00 $ -

×

Dol Goch Waterfall Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Dol Goch Waterfall Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

ATTRACTION MASTERY Course with Mystery and Beckster

1 × 194,00 $

ATTRACTION MASTERY Course with Mystery and Beckster

1 × 194,00 $ -

×

The Magnetic Collective with Becky Keen

1 × 69,00 $

The Magnetic Collective with Becky Keen

1 × 69,00 $ -

×

The Inner Dimensions of Mastering Money by Tami Simon

1 × 31,00 $

The Inner Dimensions of Mastering Money by Tami Simon

1 × 31,00 $ -

×

Free Traffic Workshop with Tony Shepherd

1 × 5,00 $

Free Traffic Workshop with Tony Shepherd

1 × 5,00 $ -

×

Recycle Your Art with Andrea Chebeleu

1 × 5,00 $

Recycle Your Art with Andrea Chebeleu

1 × 5,00 $ -

×

Oechsli Learning Center

1 × 69,00 $

Oechsli Learning Center

1 × 69,00 $ -

×

The Replaceable Founder Course with Ari Meisel

1 × 209,00 $

The Replaceable Founder Course with Ari Meisel

1 × 209,00 $ -

×

The Unchained Man: The Alpha Male 2.0 with Caleb Jones

1 × 5,00 $

The Unchained Man: The Alpha Male 2.0 with Caleb Jones

1 × 5,00 $ -

×

MageAI Unlimited with Satish Gaire

1 × 5,00 $

MageAI Unlimited with Satish Gaire

1 × 5,00 $ -

×

Textures Rural Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Textures Rural Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Film Booth – The Avatar Workshop 2023

1 × 5,00 $

Film Booth – The Avatar Workshop 2023

1 × 5,00 $ -

×

The Persuasion Equation - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $

The Persuasion Equation - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $ -

×

Channel Junkies University Premium with Channel Junkies

1 × 209,00 $

Channel Junkies University Premium with Channel Junkies

1 × 209,00 $ -

×

Alkaline Awakening with Revival Of Wisdom

1 × 5,00 $

Alkaline Awakening with Revival Of Wisdom

1 × 5,00 $ -

×

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $

Workshop: Breakthrough Or Bust: Cut Through The Marketing Noise with Customer-Centric Emails - Joanna Wiebe

1 × 5,00 $ -

×

RANK AND RENT with Tony Newton

1 × 5,00 $

RANK AND RENT with Tony Newton

1 × 5,00 $ -

×

Rope Flow Beginners – 8-WEEKS TO FLUIDITY with Timothy Shieff

1 × 5,00 $

Rope Flow Beginners – 8-WEEKS TO FLUIDITY with Timothy Shieff

1 × 5,00 $ -

×

Strong Core Tight Abs Workout Challenge - DanceFit By Monica Landois

1 × 6,00 $

Strong Core Tight Abs Workout Challenge - DanceFit By Monica Landois

1 × 6,00 $ -

×

WIM HOF Live Online Experience 2018 - Wim Hof

1 × 5,00 $

WIM HOF Live Online Experience 2018 - Wim Hof

1 × 5,00 $ -

×

Beyond Self Hypnosis 2020 (full version) with Igor Ledochowski

1 × 39,00 $

Beyond Self Hypnosis 2020 (full version) with Igor Ledochowski

1 × 39,00 $ -

×

Ascension Mystery School 3.0: Gateway to Galactic Mind with David Wilcock

1 × 46,00 $

Ascension Mystery School 3.0: Gateway to Galactic Mind with David Wilcock

1 × 46,00 $ -

×

Creating Seamless Textures in Photoshop with Stone River eLearning

1 × 6,00 $

Creating Seamless Textures in Photoshop with Stone River eLearning

1 × 6,00 $ -

×

SHIFT by Julien Blanc

1 × 5,00 $

SHIFT by Julien Blanc

1 × 5,00 $ -

×

Account Monitoring and Warning Signs with Scott Powell - CFI Education

1 × 15,00 $

Account Monitoring and Warning Signs with Scott Powell - CFI Education

1 × 15,00 $ -

×

Irvin Yalom on Grief, Loss, and Growing Old

1 × 8,00 $

Irvin Yalom on Grief, Loss, and Growing Old

1 × 8,00 $ -

×

P90X with Tony Horton

1 × 5,00 $

P90X with Tony Horton

1 × 5,00 $ -

×

The Woman’s Vitality Summit

1 × 5,00 $

The Woman’s Vitality Summit

1 × 5,00 $ -

×

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $

The Blueprint Training 2020 with Ryan Stewart

1 × 5,00 $ -

×

Start to Finish - Brutal Violent Dubstep with Dan Larsson

1 × 15,00 $

Start to Finish - Brutal Violent Dubstep with Dan Larsson

1 × 15,00 $ -

×

Money Doubler with Glynn Kosky

1 × 5,00 $

Money Doubler with Glynn Kosky

1 × 5,00 $ -

×

GMBs Verification 2024

1 × 5,00 $

GMBs Verification 2024

1 × 5,00 $ -

×

How to Make Your Podcast Sound Great with Ray Ortega

1 × 5,00 $

How to Make Your Podcast Sound Great with Ray Ortega

1 × 5,00 $ -

×

6 Figure Promotions with Tej Dosa

1 × 15,00 $

6 Figure Promotions with Tej Dosa

1 × 15,00 $ -

×

The Truth About Cancer Eastern Medicine – Gold Edition

1 × 23,00 $

The Truth About Cancer Eastern Medicine – Gold Edition

1 × 23,00 $ -

×

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $

The Willpower Instinct: How Self-Control Works, Why It Matters, and What You Can Do to Get More of It - Kelly McGonigal

1 × 5,00 $ -

×

Mole Richardson Wind Machine Fan 3D Model with PRO EDU

1 × 8,00 $

Mole Richardson Wind Machine Fan 3D Model with PRO EDU

1 × 8,00 $ -

×

Taoist Breathing 2022 Summer Retreat (Two Weeks) with Bruce Frantzis

1 × 155,00 $

Taoist Breathing 2022 Summer Retreat (Two Weeks) with Bruce Frantzis

1 × 155,00 $ -

×

Media Buyer’s Toolkit

1 × 5,00 $

Media Buyer’s Toolkit

1 × 5,00 $ -

×

Gut Health Makeover with Kim Foster

1 × 179,00 $

Gut Health Makeover with Kim Foster

1 × 179,00 $ -

×

Learning to Light Day Exteriors with Shane Hurlbut

1 × 8,00 $

Learning to Light Day Exteriors with Shane Hurlbut

1 × 8,00 $ -

×

Shamanic Rituals to Embody the Healing Power of Spirit Animals - Puma Fredy Quispe Singona - The Shift Network

1 × 54,00 $

Shamanic Rituals to Embody the Healing Power of Spirit Animals - Puma Fredy Quispe Singona - The Shift Network

1 × 54,00 $ -

×

HUMAN MECHANICS ONLINE 10 WEEK COURSE with Mads Tömörkènyi

1 × 5,00 $

HUMAN MECHANICS ONLINE 10 WEEK COURSE with Mads Tömörkènyi

1 × 5,00 $ -

×

Half Guard: sweeps and submissions with André Monteiro

1 × 6,00 $

Half Guard: sweeps and submissions with André Monteiro

1 × 6,00 $ -

×

How I make $15K+ per week with Simple Software - Secret Marketer

1 × 5,00 $

How I make $15K+ per week with Simple Software - Secret Marketer

1 × 5,00 $ -

×

Blocking & Lighting A-Z with Shane Hurlbut

1 × 8,00 $

Blocking & Lighting A-Z with Shane Hurlbut

1 × 8,00 $ -

×

KPI Profit Blueprint with Matt Larson

1 × 69,00 $

KPI Profit Blueprint with Matt Larson

1 × 69,00 $ -

×

3-Day Dialectical Behavior Therapy Certification Training by Lane Pederson

1 × 31,00 $

3-Day Dialectical Behavior Therapy Certification Training by Lane Pederson

1 × 31,00 $ -

×

Dappled Light Forest Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Dappled Light Forest Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Business by Design: Journey By Unlock Your Design Academy

1 × 23,00 $

Business by Design: Journey By Unlock Your Design Academy

1 × 23,00 $ -

×

The Chad Mindset: Forge an Unbreakable Mental Framework with Jacked Aecus

1 × 5,00 $

The Chad Mindset: Forge an Unbreakable Mental Framework with Jacked Aecus

1 × 5,00 $ -

×

Digital Banking Fundamentals with Esteban Santana - CFI Education

1 × 15,00 $

Digital Banking Fundamentals with Esteban Santana - CFI Education

1 × 15,00 $ -

×

Isle of Skye Rolling Seaside Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Isle of Skye Rolling Seaside Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Sixty Years of Challenge - More Numbers, Less Flakes

1 × 5,00 $

Sixty Years of Challenge - More Numbers, Less Flakes

1 × 5,00 $ -

×

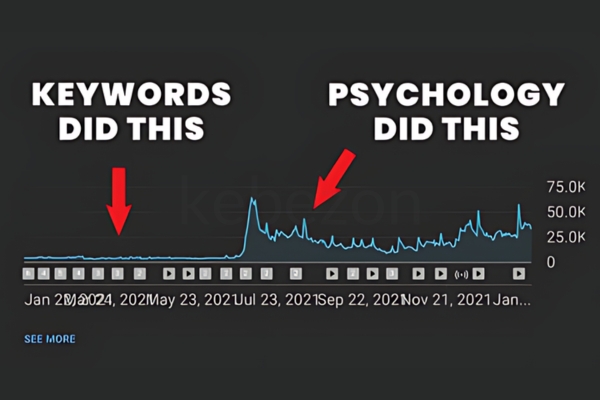

SEO That Works 4.0 with Brian Dean

1 × 5,00 $

SEO That Works 4.0 with Brian Dean

1 × 5,00 $ -

×

EXSTORE Orthopedic System Online Training - Anthony Lombardi

1 × 389,00 $

EXSTORE Orthopedic System Online Training - Anthony Lombardi

1 × 389,00 $ -

×

Classic jiu-jitsu with Mauricio Gomes

1 × 6,00 $

Classic jiu-jitsu with Mauricio Gomes

1 × 6,00 $ -

×

Make Compelling Videos That Go Viral - Marques Brownlee

1 × 6,00 $

Make Compelling Videos That Go Viral - Marques Brownlee

1 × 6,00 $ -

×

Investishare – Bundle 3 Courses

1 × 5,00 $

Investishare – Bundle 3 Courses

1 × 5,00 $ -

×

Effortless Content: The Quick & Dirty Way To Create GREAT Content - Ryan Booth

1 × 5,00 $

Effortless Content: The Quick & Dirty Way To Create GREAT Content - Ryan Booth

1 × 5,00 $ -

×

Standing Practice with Chow Gar Tong Long

1 × 4,00 $

Standing Practice with Chow Gar Tong Long

1 × 4,00 $ -

×

Urotherapy: The Ancient Art of Self-Healing - Edward Group

1 × 69,00 $

Urotherapy: The Ancient Art of Self-Healing - Edward Group

1 × 69,00 $ -

×

Ormus Protocol (Advanced) by Spirituality Zone

1 × 11,00 $

Ormus Protocol (Advanced) by Spirituality Zone

1 × 11,00 $ -

×

Blackstone Edge Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Blackstone Edge Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

The Giant Tutorial with Richard Wakefield

1 × 8,00 $

The Giant Tutorial with Richard Wakefield

1 × 8,00 $ -

×

The Iodine Crisis: What You Don’t Know About Iodine Can Wreck Your Life (PDF+Mp3) with Lynne Farrow

1 × 6,00 $

The Iodine Crisis: What You Don’t Know About Iodine Can Wreck Your Life (PDF+Mp3) with Lynne Farrow

1 × 6,00 $ -

×

Print and Product Selling Guide with Twig & Olive

1 × 5,00 $

Print and Product Selling Guide with Twig & Olive

1 × 5,00 $ -

×

How Billionaires, Icons, and World-Class Performers Master Productivity with Tim Ferriss

1 × 5,00 $

How Billionaires, Icons, and World-Class Performers Master Productivity with Tim Ferriss

1 × 5,00 $ -

×

Major Mark Life Mastery with Mark Cunningham

1 × 23,00 $

Major Mark Life Mastery with Mark Cunningham

1 × 23,00 $ -

×

What's New In Unity 5 with Stone River eLearning

1 × 6,00 $

What's New In Unity 5 with Stone River eLearning

1 × 6,00 $ -

×

Viral Animated Reels (Minimalist After Effects Animation Training) - Weiss Video & Visual Hustles

1 × 5,00 $

Viral Animated Reels (Minimalist After Effects Animation Training) - Weiss Video & Visual Hustles

1 × 5,00 $ -

×

Seas And Waves Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $

Seas And Waves Composite Stock Assets with Clinton Lofthouse

1 × 8,00 $ -

×

Perform Energy Clearings on Yourself & Other People - Jean Haner

1 × 39,00 $

Perform Energy Clearings on Yourself & Other People - Jean Haner

1 × 39,00 $

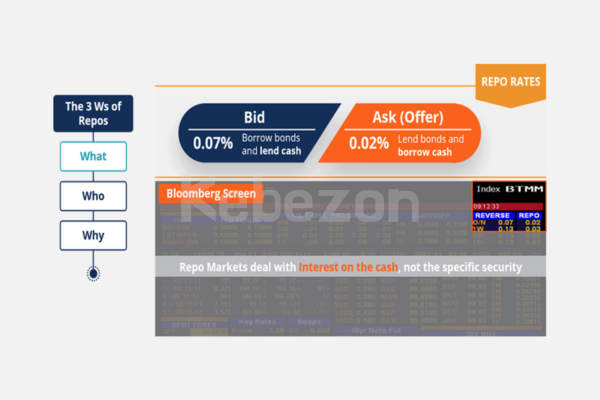

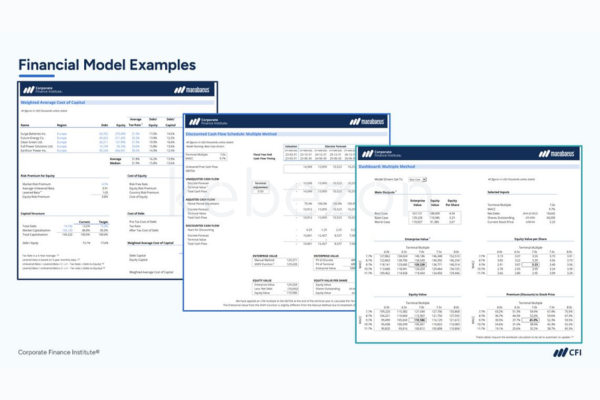

Repo (Repurchase Agreements) By Meeyeon Park – CFI Education

15,00 $

SKU: KEB. 44820mzVc37bD

Category: Finance

Tags: CFI Education, Meeyeon Park, Repo, Repurchase Agreements

You may check content proof of “Repo (Repurchase Agreements) By Meeyeon Park – CFI Education” below:

Understanding Repurchase Agreements: Insights from Meeyeon Park

In the complex world of borrowing and lending inside financial markets, repurchase agreements, or repos, are an essential financial tool. These agreements provide a systematic approach to managing short-term funding needs while guaranteeing transaction security, as explained by Meeyeon Park, Vice President of Private Wealth Management at the Corporate Finance Institute (CFI). Through the prism of Meeyeon Park’s vast experience, this paper explores the fundamentals of repos, the dangers they include, and their importance in preserving liquidity in financial markets.

The Mechanics of Repurchase Agreements

What is a Repurchase Agreement?

Under buyback agreements, one party sells securities to another with the understanding that the same securities would be bought back later at a fixed price. This arrangement is a result of the demand for both security and liquidity. The securities are essentially turned into a short-term loan by the seller using them as collateral. Consider a repo, for example, as a cordial handshake *** between two people; one loans money, and the other provides securities as collateral and a means of confidence.

This arrangement is crucial to the overall state of the economy and goes beyond simple financial flow. The repo market really acts as the foundation for a number of financial operations, enabling organizations to effectively manage their asset portfolios without having to sell up precious assets. Park emphasizes that these transactions are particularly useful during periods of market volatility, providing financial institutions the liquidity needed to navigate uncertainties.

The Scale of Repo Utilization

Repos are ubiquitous in the financial world, with estimates suggesting that financial firms engage in borrowing approximately $4 trillion through repos. This substantial figure underscores the reliance of financial institutions on repos as a financing mechanism. To illustrate the scale further, consider the following table that outlines various aspects of repo transactions:

| Aspect | Details |

| Market Size | Approximately $4 trillion in borrowed funds |

| Key Participants | Banks, hedge funds, insurance companies, and other financial entities |

| Collateral Types | Government bonds, corporate bonds, and other securities |

| Duration | Typically overnight to a few weeks |

This table succinctly captures the fundamental nature of repo transactions, illustrating not only their prevalence but also the diversity of participants involved.

The Importance of Repos in Liquidity Management

How Repos Facilitate Liquidity

A key component of today’s fast-paced financial industry is efficient liquidity management. Without having to sell their assets completely, financial institutions may swiftly turn their securities into cash through repos. For a number of functions, including as financing trading positions, managing unplanned costs, and satisfying regulatory requirements, this liquidity is essential.

According to Park, repos are a well-designed financial lifeline that may give institutions the rapid cash infusions they sorely need to continue operating when markets are volatile or crises are imminent. Financial systems may experience significant disruptions in the absence of this mechanism, which might result in wider market volatility.

Repo Markets during Crises

Historically, during financial crises, the repo market has proven to be a lifeline. For example, during the 2008 financial crisis, repos helped institutions navigate liquidity challenges, allowing them to stabilize their operations while managing the fallout from asset devaluation. The repo market serves as both a barometer and a bulwark against economic turbulence, highlighting its critical role in financial resilience.

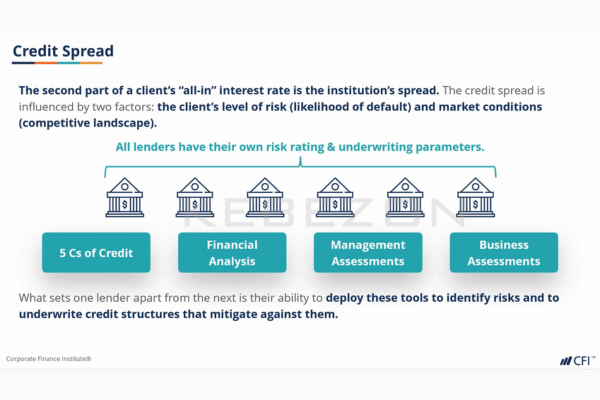

Risks Associated with Repurchase Agreements

Understanding the Inherent Risks

Even though repos have several basic advantages, Meeyeon Park is not afraid to discuss the hazards involved with these financial products. It’s critical to understand that, despite their potential to offer liquidity, repos have certain inherent risks. The following are the main dangers involved:

- Default risk is the possibility that the buyer may suffer losses if the seller does not buy back the securities.

- Collateral Risk: Situations where the collateral is insufficient to support the amount borrowed may arise due to shifts in the collateral’s market value.

- Legal Risk: If the agreements’ provisions are unclear or poorly understood, problems might occur and litigation could result.

The Impact of Market Conditions

Because financial markets are dynamic, the security and stability of repos might change depending on the situation. When the collateral’s value drops, margin calls may be initiated, forcing the borrowing party to submit more collateral or risk liquidation. Both parties may be impacted by this vulnerability, which might have a domino effect and jeopardize financial stability.

To comprehend these risks ***ter, consider the following list outlining the potential hazards involved in repos:

- Default Risk: The risk of the counterparty failing to fulfill obligations.

- Collateral Valuation Risk: Fluctuating prices of collateral leading to insufficient coverage of borrowed amounts.

- Liquidity Risk: Potential difficulty in quickly selling the collateral in a stressed market.

- Legal Compliance Risk: Issues arising from non-compliance with regulatory requirements.

Addressing these risks requires vigilance, robust risk management strategies, and comprehensive legal frameworks to protect all parties involved.

Conclusion: The Dual Nature of Repurchase Agreements

In conclusion, Meeyeon Park provides deep understanding of the function of repos in financial markets, exposing their intricacy and inherent dangers. Although repurchase agreements are a crucial financial mechanism that improves liquidity and operational effectiveness, they also carry a number of serious risks that should be carefully considered and managed. The contrast between these benefits and weaknesses draws attention to the fine balance that financial institutions need to keep.

The significance of repos will only grow as we traverse a more linked global financial environment. Our knowledge of these complex instruments may be expanded by using materials from professionals like Meeyeon Park, which will better prepare us to handle the possibilities and difficulties that lie ahead. Examining the courses and resources offered by the Corporate Finance Institute is a wise next step for anybody looking to improve their financial literacy.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Repo (Repurchase Agreements) By Meeyeon Park – CFI Education” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.